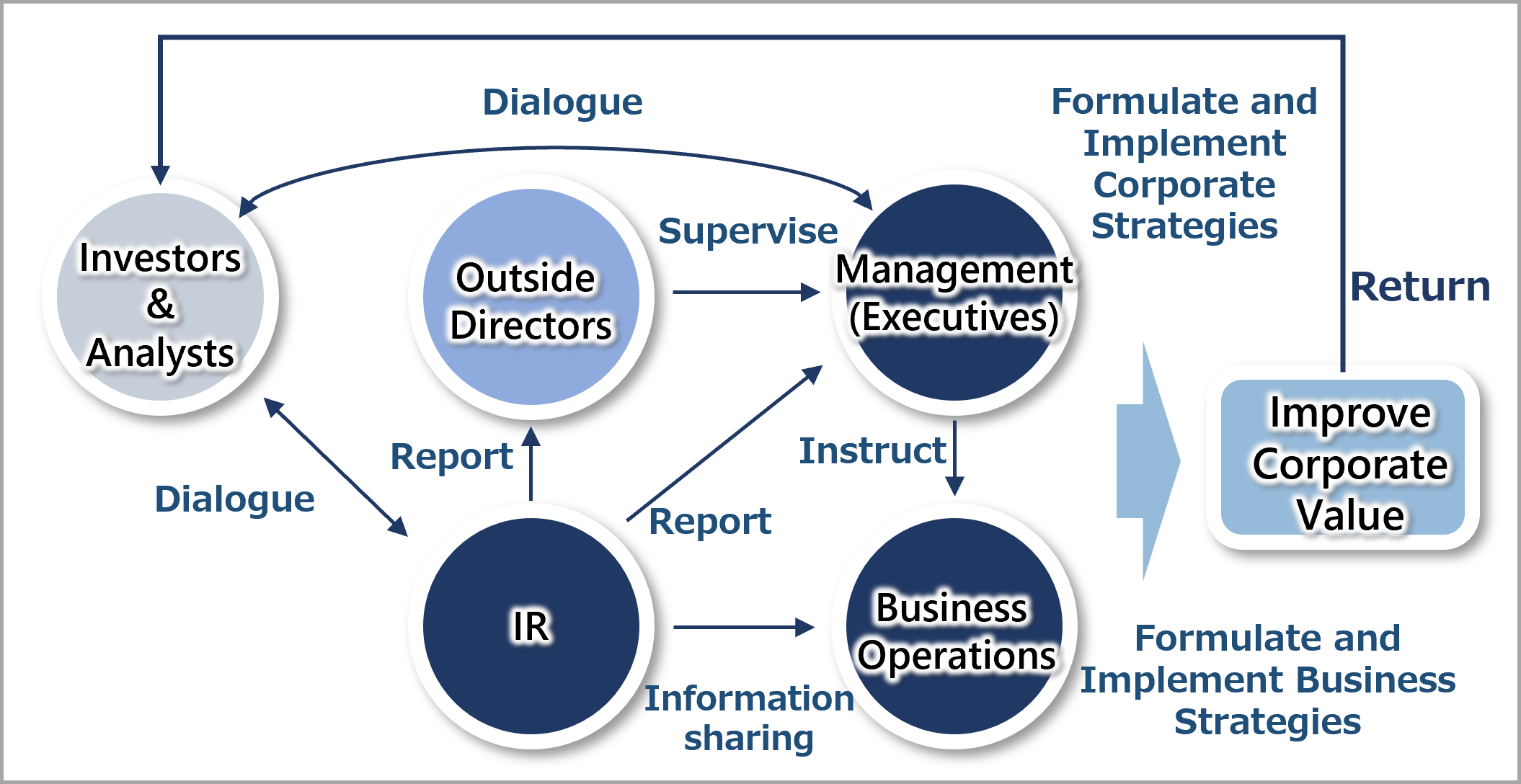

To enhance corporate value, we believe it is important to communicate a roadmap for achieving stable long-term cash flow growth and improved capital efficiency, which incorporates a shift to electrification, and for Honda’s future potential to be common knowledge in the capital markets.

Toward this end, our management executives take the initiative in engaging in more active dialogues than ever before through events and individual meetings, so that shareholders, investors, and other stakeholders can fully comprehend and evaluate our management direction.

Through such dialogues, management executives directly grasp what the capital markets are looking for as well as what they are interested in. This valuable feedback from our stakeholders is utilized in management to further improve corporate value.

We hold financial results briefings four times a year for shareholders and investors in Japan and overseas, with providing simultaneous translation to deepen understanding of the Honda's business strategies. In addition, our CEO joined the briefing at the end of fiscal year financial results.

Furthermore, the minutes of the briefing were available in Japanese and English, for those who were unable to attend the briefings. We also held press conferences by CEO, as well as business and technology briefings and on-site interview sessions.

In addition, held events for individual investors to explain business strategies, in collaboration with securities companies.

- 拡大

- (May 2024, Business Briefing)

In addition to management executives, the IR department proactively engages in dialogues with investors and securities analysts, primarily value- and growth-oriented investors.

Under the supervision of the CFO, the IR department, which consists of members with diverse backgrounds including accounting and finance, public relations, general affairs, purchasing, and sales, who participate in constructive dialogues with investors and securities analysts. The IR department also handles the exercising of voting rights and ESG-related dialogues.

|

Categories |

FYE March 31, 2024 |

FYE March 31, 2025 |

|

|

Dialogues with investors/analysts |

1,012 |

1,373 |

|

|

Dialogues with investors |

920 |

1,273 |

|

|

Dialogues with analysts |

92 |

100 |

|

|

Conference participation |

14 |

14 |

|

Through dialogue with our stakeholders, we gain an understanding of their interests and concerns and use this information as valuable feedback within the company to formulate management strategies.

|

Category |

Main Topics |

|

Automobile Business |

Demand situation per markets |

|

Sales situation of HEV |

|

|

Motorcycle Business |

Outlook for ICE business |

|

Sustainability of high profitability |

|

|

Electrification |

Perception of BEV market slowdown |

|

Progress in electrification strategies |

|

|

Returning Profits to Shareholders |

Policy on returning profits to shareholders |

|

Others |

Roadmap to achieve PBR 1x |

|

Impact of tariffs from the new US administration |

|

|

Outlook for Chinese business |

|

|

Strategic partnership aimed at the era of intelligence and electrified vehicle |

Opinions and other feedback from investors and securities analysts are shared among management executives and internal stakeholders in a timely manner as a reference for formulating corporate management strategies to improve our corporate value.