Accelerating Initiatives to Prepare for Future Growth with

an Eye Toward the Imminent Arrival of the CASE Era

Honda identified “mobility, energy and robotics” as new areas to focus on to “create value for mobility and people’s daily lives.

Around this time, “CASE” quickly became a popular word that represents the next generation of the mobility industry. CASE stands for “Connected, Automated, Shared and Electrified,” and these were the words first used in the mid- to long-term strategy announced by Daimler-Benz AG (later Mercedes-Benz AG) at the Paris Motor Show in September 2016.

Based on the original concept of CASE, Honda advocated a Honda-style “CASE+e,” by attaching the meanings of “mobility service” and “energy service” to the S, and then adding “+e” to represent “energy (renewable energy).”

Then, Honda conceived a new concept, called Honda eMaaS (Honda Energy Mobility as a Service) which integrates MaaS (Mobility as a Service) and EaaS (Energy as a Service).

MaaS is a concept for a new, efficient and convenient form of mobility where all modes of transportation such as trains, buses, taxis, ride-sharing, and shared bicycles are seamlessly connected with IT and other technologies. The original concept of Honda eMaaS is to connect electrified mobility products and energy services with AI-powered connected technologies, so that Honda can offer optimal mobility and greater freedom for customers, while also contributing to the expansion of the utilization of renewable energy.

Honda eMaaS, which expands the scope to include not only mobility products such as motorcycles and automobiles, but also energy and robotics technologies, leverages the unique strengths of Honda (a wide range of products and technologies including motorcycles, automobiles, power products, aircraft, jet engines, and robotics), and leads directly to the Honda vision to create new products for mobility and people’s daily lives.

In September 2016, prior to the announcement of the 2030 Vision, Honda established the Honda R&D Innovation Lab Tokyo in Akasaka, Tokyo, as a base where Honda conducts research into cutting-edge intelligent technologies such as Al to create new value. Honda began making steady progress in preparation for the future growth.

Pioneering the Once-in-100-years Transformation Period

of the Mobility Industry by Collaborating with Optimal Partners

In the 1990s and early 2000s, in the midst of the great swell of restructuring in the automobile industry, Honda maintained its “spirited independence.” Creating new technologies with its own hands had undoubtedly been the Honda corporate identity ever since its founding period. However, in the face of the once-in-100-years paradigm shift occurring in the mobility industry, represented by the shift toward CASE technologies, it is essential for Honda to seek the best possible partnerships for its transformation, and this is clearly stated in the 2030 Vision as well.

It was often said that Honda has a policy to pursue “self-sufficiency” or an “in-house approach;” however, Honda had a history of working together with a variety of other companies. With a massive wave of technological innovation sweeping through the automotive industry, active collaboration with outside parties has become vital, and the scope of such collaboration has expanded dramatically compared to the collaboration of the past. In 2018, Honda announced plans to collaborate with GM and GM Cruise Holdings LLC on the development of purpose-built autonomous vehicle for a driverless ride-sharing service. Prior to this announcement, Honda and GM had already been jointly developing next-generation fuel cell systems and collaborating in the area of EV batteries.

Examples of collaboration with other companies include the joint research with Softbank Corp. in the field of Al that started in 2016, and in connected car technologies based on 5G (the fifth generation of cellular technology) in 2017. Moreover, in 2019, Honda signed an agreement for a capital and business partnership with MONET Technologies Inc., a joint venture between Toyota Motor Corporation and SoftBank Corp., to further enhance its mobility services. Since then, Honda has continued to forming alliances with various companies, including IT companies.

In February 2020, Honda established Honda Mobility Solutions Co., Ltd., a subsidiary responsible for planning and operating mobility services (MaaS), and began research into new services that combine various services and technologies including mobility services utilizing automated driving technologies, robotics and energy technologies.

Hachigo explained his thoughts toward these collaboration initiatives, “We must not pursue too much originality and become complacent. In this age of diversifying consumer needs, lifestyles and values, we must not neglect our efforts to go to the spot where things are actually happening and listen to what the market has to say.*5” Hachigo stressed that the most important attitude for each individual in the manufacturing industry was the “Three Reality Principle,” which emphasizes the importance of going to the real spot, understanding the real situation and making realistic decisions to solve the issue, rather than relying solely on theories.

While forming alliances with a wide range of companies and focusing on the creation of new value suitable for the new era, Honda upholds the Honda Philosophy as its underlying principle.

- July 2, 2017 issues of the Nikkan Kogyo Shimbun

Solidifying Existing Business While Pursuing Painful Reforms

In addition to taking on challenges to cultivate new business areas, the 2030 Vision strongly emphasized the need to solidify existing businesses. In particular, strengthening the automobile business structure and facilitating highly efficient and profitable automobile development were identified as urgent management challenges.

Honda has enhanced its overall competitiveness by complementing its global models with regional models. In order to further enhance its competitive edge, Honda began undertaking initiatives to increase both the attractiveness of its products and the efficiency of its business by reducing the number of regional models as well as the number of variations at the trim and option level for global models Honda was offering beyond the actual customer needs. Through this “selection and concentration” approach, Honda sought to improve the efficiency of its automobile development and production.

In addition, Honda introduced the concept of “Honda Architecture” to further increase the efficiency of development and expand parts-sharing for its mass-production models. Under the concept of Honda Architecture, the basic body frame of the vehicle is divided into three modules: the engine room, cockpit and rear floor. This was an attempt to reduce the overall cost of development by sharing key specifications, structures and components among multiple models, while maintaining the individual characteristics of each model.

The manufacturing process was also reformed for greater efficiency. The key focus of this initiative was put on the North America region, which has the largest production operations among all six regions of Honda business. Since the start of local production in 1982, Honda had expanded its model lineup in North America as sales increased. Each production plant produced various models and established a system to flexibly accommodate changes in demand. However, it was undeniable that this flexibility led to a decline in the efficiency of automobile production. To address this issue, Honda strived to make its production operations simpler by reorganizing and consolidating model variations at the trim and option level, reducing the number of models each plant would produce, and reducing the number of plants that produce the same model.

In October 2017, Honda announced that it would transfer automobile production from Saitama Factory’s Sayama Plant, one of the main Honda automobile plants in Japan, to Yorii Automobile Plant by around the fiscal year ending March 31, 2022. Until then, Honda had been upholding its goal to “maintain automobile production volume of 1 million units in Japan” and maintained production capacity of 1.06 million units. However, Hachigo announced the plan to reduce the capacity to 810,000 units by 2021. By that time, Honda automobile sales in Japan had been stagnant at the level of 700,000 units. Therefore, this decision to consolidate production operations was unavoidable.

Saitama Factory Yorii Plant (Currently, Saitama Factory Automobile Plant)

Welding process at the Saitama Factory Yorii Plant

Final inspection at the Saitama Factory Yorii Plant

Moreover, in order to eliminate the gap between production capacity and sales volume, Hachigo also made a decision to close or consolidate some Honda plants outside Japan, including Thailand, Brazil, the U.K., Turkey, Argentina and Mexico, and pushed through with the painful reforms which involved layoffs at some operations outside Japan.

Hachigo explained the background of the decisions: “The Sayama Plant was getting outdated, and the production volume of Honda of the UK Manufacturing (HUM) in Swindon, located in the southern part of England, was gradually declining. In fact, they had to suspend production on Fridays, and associates instead were cleaning the plant or receiving training on Fridays. My thinking was that if we continue operating those production plants where the “Joy of Creating” has been lost and that would cause hardship for associates at the spot, it would be better for the company to ask them to move on to a new stage, after we try everything we can do as a company. With this belief, we decided to close those plants.”

These reform measures were implemented with a focus on solidifying existing businesses; however, at the same time, they were agonizing choices Hachigo had to make to restore the “Joy of Creating” for associates.

Shifting from the Collaborative SEDB Structure to a

Unified Structure: Making Bold Changes to Organizational

and Operational Structures of Motorcycle and Automobile

Operations

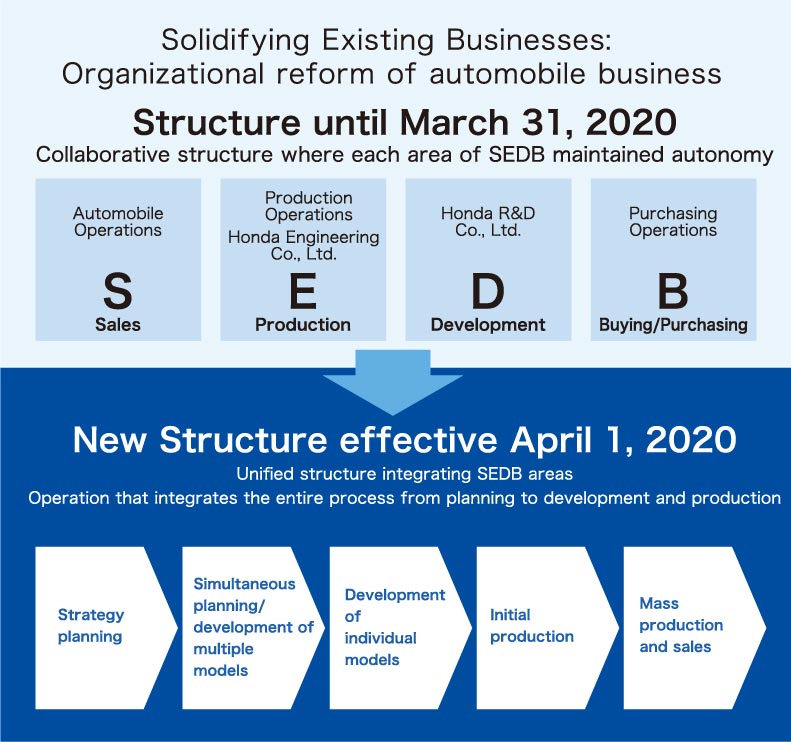

In order to solidify existing businesses and create new value in the CASE era, Honda also needed to reform its organizational and operational structure.

For a long time, Honda had an operational structure where each area of SEDB (Sales, Engineering/production, Development and Buying/purchasing) maintained autonomy and played their respective roles while working in collaboration with each other to maintain good balance for the entire business. However, this system had become unable to function fully for a variety of reasons, including expansion of the scale of business and changes in the societal environment and customer values. Moreover, as mentioned earlier, various challenges had arisen, such as the forming of barriers between different divisions, which resulted in a decline in efficiency. Former President Ito had transferred some R&D Center functions to Suzuka Factory, which integrated production and development divisions and gave momentum to complete the development of the N-BOX. Although his strategy had shown some concrete results, it had not generated fundamental solutions to the issues facing Honda.

Hachigo first implemented measures to improve the operational structure of motorcycle business. Since 2014, motorcycle SDB divisions had already worked together at Kumamoto Factory for the development of new motorcycle products. To further advance this structure, in February 2019, Hachigo made a decision to consolidate Motorcycle Operations and the Motorcycle R&D Center into a single organization, so that SEDB divisions would be able to achieve more interdivisional cooperation and collaboration. This consolidation was designed to enable motorcycle operations to integrate the entire process of new product planning, development, initial production, and mass production to improve not only product appeal, but also cost, quality, and development speed. Moreover, the ultimate goal of this reform was to further increase global competitiveness, implement measures to comply with increasingly stringent environmental regulations in each country, and expand and secure new markets for Honda motorcycles.

In April 2020, Honda announced changes to be made to the operational structure of its automobile business. Hachigo explained that the changes would be made “in order to further accelerate ongoing initiatives to strengthen its automobile business and realize ‘strong products, strong monozukuri (the art of manufacturing) and strong businesses,’ which would be essential for the further growth of Honda.

Specifically, the following organizations/functions were integrated into Automobile Operations: 1) Honda Motor Production Operations, Purchasing Operations and automobile business functions of Business Management Operations; 2) Honda R&D automobile product development functions except for certain functions such as product design; and 3) Honda Engineering Co. functions related to the development of automobile manufacturing technologies and the production of automobile manufacturing equipment.

With these changes, Honda made a major shift from the collaborative SEDB structure to a unified structure which integrates SEDB areas.

The Automobile Operations, which would integrate all SEDB areas, was reorganized to consist of

- 1) Business Supervisory Unit, which would be responsible for formulating business strategies to flexibly address changes in the business environment;

- 2) Monozukuri Center, which would develop competitive products;

- 3) Production Supervisory Unit, which would be responsible for automobile production and controlling and achieving production quality at a consistently high level,

- 4) Supply Chain Management Supervisory Unit, which would plan and implement the optimal supply chain; and

- 5) Sales Supervisory Unit, which would be responsible for formulating and implementing sales strategies which are unified with regional sales operations.

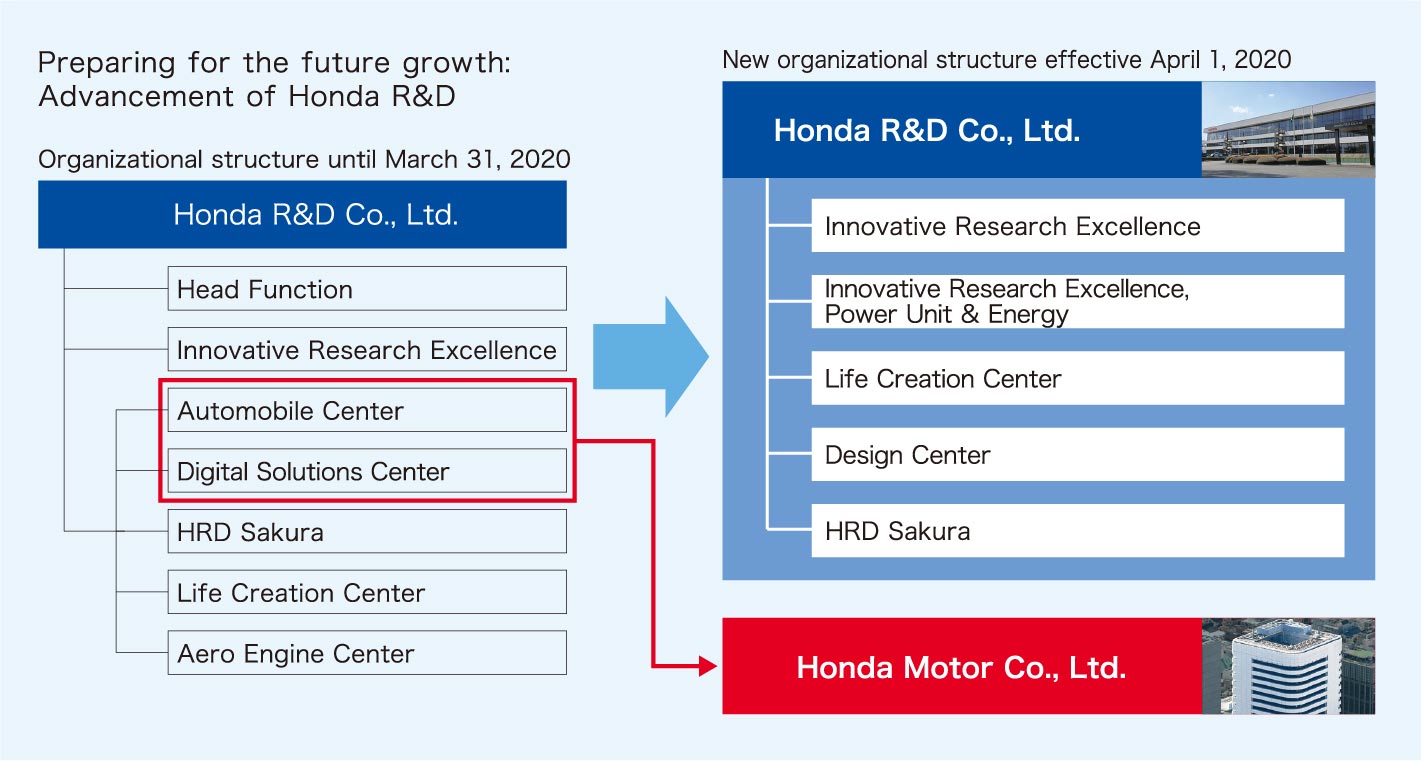

Looking back at history, it was in 1960 that Honda R&D was established as a separate company independent of Honda Motor. This separation was done in accordance with the founders’ desire to create an environment in which research and development could be conducted freely and without being influenced by the ups and downs of business, and to foster the development of innovative and original technologies. For 60 years since then, Honda R&D had developed and introduced to the market a number of innovative technologies that had served as the backbone of Honda. With the shift to the unified structure established under the leadership of Hachigo, Honda R&D divisions responsible for the development of automobile products were merged with Honda Motor, and Honda R&D became an organization specializing in exploring new technology areas unknown to Honda and conducting cutting-edge research and development to prepare Honda for value creation in the future.

Hachigo explained: “Research and development of production models must have a success rate of more than 100%. On the other hand, research and development of cutting-edge technologies, which may become the core of our business in the future, will require a strong will to take on challenges to pursue difficult themes that seem to have a failure rate of 99%. So, I thought that those two should be separated, and that is why we made a decision to pursue this organizational restructuring.”

In other words, Hachigo pushed through with this reform in order to realize the original goal of enabling Honda to continue to create new value in the future.

At the same time, in April 2020, Honda newly established MaaS Operations to integrate all functions related to CASE/Honda eMaaS strategy planning, development and business implementation, which were being assumed separately by each business operation at the time.

Through these major organizational and operational changes, the entire company began working as one “Team Honda” and accelerated various initiatives toward the fulfilment of the 2030 Vision.

Passing the Baton from Hachigo to Mibe:

Honda Begins Taking on New Challenges Toward 2050,

Beyond its 100th Anniversary

The 2019 outbreak of the novel coronavirus, named COVID-19 by the World Health Organization (WHO) on January 9, 2020, quickly led to a worldwide pandemic. In Japan, the first infected person was confirmed on January 15, 2020, and the first state of emergency was declared for the period from April to May, which had a tremendous impact on the daily lives of people and on economic and industrial activities.

Due to the various restrictions on social and economic activities of people enforced by the governments of each country around the world, Honda experienced suspended and reduced production at its production operations inside and outside Japan due to various issues such as restrictions on associates coming into their respective workplaces and delays in parts supply in the supply chain. Some Honda dealers were also forced to close their doors, shorten operating hours, and scale back maintenance and repair operations. Honda was able to resume most of its business activities by March 2021; however, consolidated sales revenue for the fiscal year ended March 31, 2021 (FY2021) experiencing a year-on-year decline of 11.8%. Even in such a difficult business environment, Honda managed to achieve a 4.2% year-on-year increase of operating profit with its cost reduction efforts and a decrease in selling, general & administrative expenses.

On February 19, 2021, Honda held a press conference to announce the appointment of Toshihiro Mibe as its new president.

The six years under the leadership of Hachigo represented a major period of transformation of the automobile business environment, and Honda underwent a series of structural reforms. By closing several production plants around the world, including Sayama Plant and the plant in the U.K, Honda pushed through the optimization of production capacity and its workforce. The 2030 Vision was formulated to ensure that Honda would continue to be “a company that society wants to exist” in the future. In the midst of the once-in-100-years paradigm shift happening in the mobility industry, represented by the emergence of CASE technologies, Honda worked to solidify existing business and prepare for future growth.

At the press conference announcing the new president, Hachigo said: “Last April, we laid a new structure for Honda R&D as well as for automobile product development at Honda Motor, which completed the structure I had in mind. Now, Honda is ready to accelerate electrification, and I thought now is the time I should pass the baton.”

Mibe, who assumed the role as the ninth president of Honda, said: “[My responsibility] is to construct a ‘building,’ in which Honda will continue to grow into the future, and it must be resilient to withstand this once-in-100-years period of transformation.”

After his formal appointment as president on April 1, Mibe held his inaugural press conference on April 23, 2021. In this press conference, Mibe announced new 2050 targets in key focus areas – safety and the environment: “zero traffic collision fatalities” involving Honda motorcycles and automobiles globally and “carbon neutrality” for all Honda products and corporate activities Honda.

He also announced the electrification target of increasing the sales ratio of battery-electric vehicles (EVs) and fuel cell electric vehicles (FCVs) to 100% globally by 2040, making Honda the first automaker to declare the complete transition away from combustion engines in the future. Under the new leader, Honda began taking on new challenges for the future.

Toshihiro Mibe (left) and Takahiro Hachigo (right)