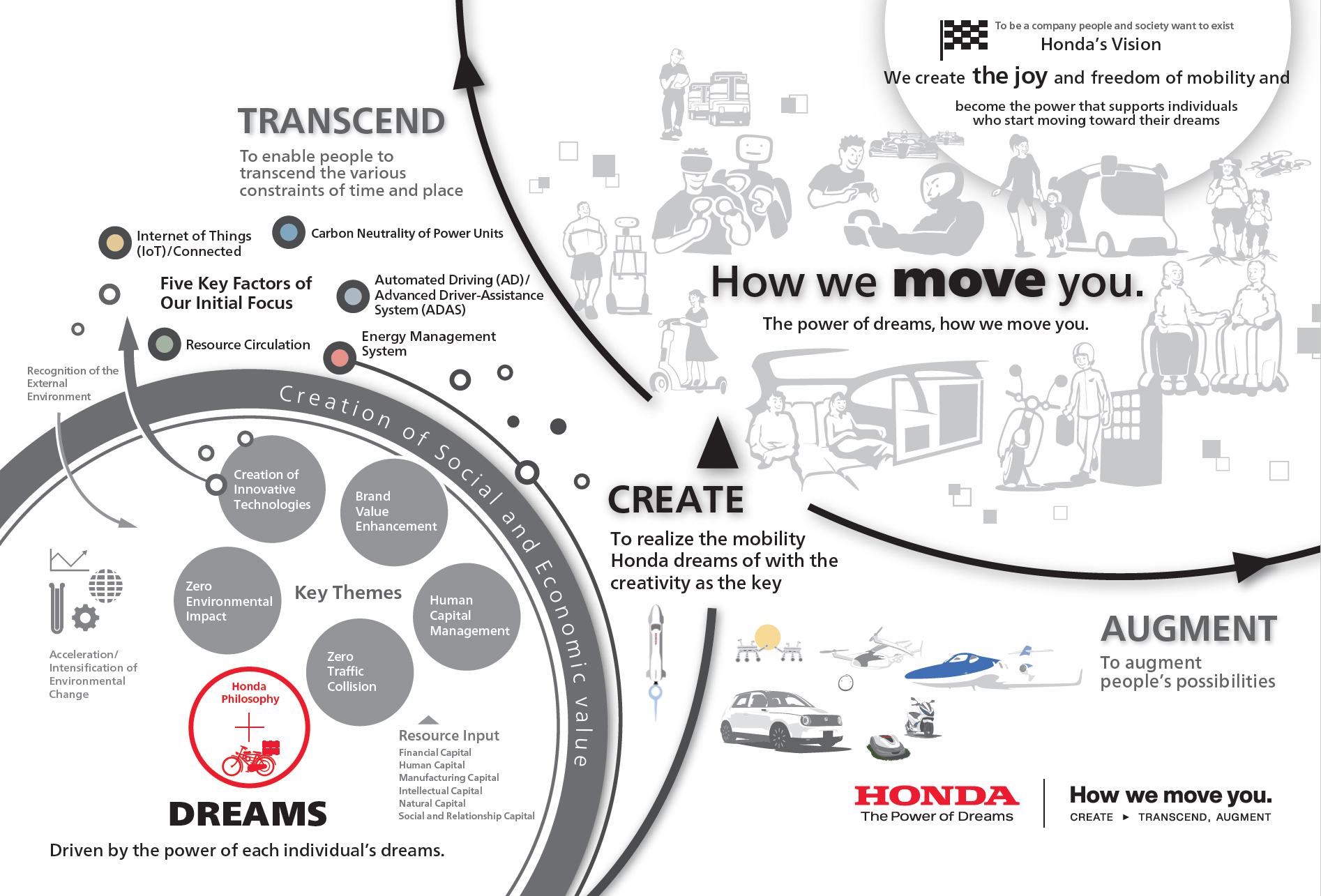

Motorcycle Business Strategy

Delivering Unique and Appealing Honda Motorcycles to Customers Worldwide

Delivering Unique and Appealing Honda Motorcycles to Customers Worldwide

Honda’s motorcycle business, which is the origin of its manufacturing and a core part of its heritage, has developed a wide range of products over its 75-year history, meeting diverse needs and applications across the globe. Today, with approximately 30,000 dealers worldwide and an annual global sales volume of around 20 million units, Honda has grown into a top manufacturer in the motorcycle industry.

The world’s largest production volume is supported by globally unified platforms and optimal supply systems for each category, maintaining Honda’s unique appeal and high-efficiency operations.

Honda remains committed to providing customers around the world with rich experiences through motorcycles. Beyond practicality, Honda aims to enhance the joy of motorcycle life, including the thrill of riding and community building, while meeting customer expectations for safety and reliability. Honda will continue to explore new possibilities in the motorcycle market and lead the world as a pioneering company.

Revenue Highlights of the Motorcycle Business

Growing Demand for Electric Motorcycles and Regional Disparities

The motorcycle market is expected to continue expanding, particularly in countries with a high proportion of young people.

In India, the world’s largest motorcycle market, there is a rapid increase in demand for electric motorcycles, supported by favorable policies. Other countries face varying challenges related to infrastructure, such as stable power supply and charging networks, and differences in government sales support and industry development measures. However, the long-term trend toward the expansion of electric motorcycles is anticipated to continue. Honda, taking this situation into account, will strategically allocate resources based on the pace of expansion for internal combustion engine (ICE) motorcycles and electric motorcycles in each market, leveraging its strengths to compete with emerging electric manufacturers.

In addition to developed countries, demand for FUN motorcycles is also expanding in China and other emerging Asian countries. To enrich the motorcycle experience and offer both the enjoyment of manual transmission (MT) and the comfortable touring characteristics of automatic transmission (AT) models, Honda has introduced the world’s first motorcycle with an electronic-controlled clutch, "Honda E-Clutch." This new value technology has been highly praised, and we plan to expand its application to more models in the future.

Leading Environmental and Safety Innovations: “More Convenience, More Freedom”

Motorcycles play a vital role in supporting people’s lives, especially in emerging countries like those in Asia, serving as a central element of social infrastructure.

To realize a safe and secure mobility society, Honda will expand models equipped with advanced safety technologies such as advanced brakes and LED lighting to enhance rider visibility and recognition, while also continuing global safety driving education.

In addressing environmental challenges, Honda will accelerate efforts beyond electrification of power units to achieve carbon neutrality. These efforts include improving fuel efficiency in the ICE sector, developing technologies for bioethanol fuel as an alternative to gasoline, expanding the use of biomass resin materials, and achieving carbon-neutral factories tailored to regional characteristics. By pursuing these initiatives, Honda aims to become a frontrunner in environmental sustainability.

Direction of Electrification Business Strategy

Honda positions 2024 as the inaugural year for the global expansion of its electric motorcycles, marking the beginning of a full-scale entry into the electric motorcycle market. The period up to 2026 is defined as the market entry phase, 2026 to 2030 as the business expansion phase, and post-2030 as the full-scale business growth phase. Honda will strategically promote the introduction of electric motorcycles into the market throughout these phases.

In the near term, Honda will introduce battery-swapping models with “Honda Mobile Power Pack e: (MPP).”, targeting the rapidly growing electric motorcycle markets in India and ASEAN countries, aiming to enter and expand sales in these markets. By 2025, Honda plans to launch models with fixed batteries, broadening the product lineup.

Regarding electric products, Honda will combine its strengths in ICE vehicles with the appeal of electric vehicles to create attractive electric motorcycles unique to the brand.

In production, procurement, and development, Honda will leverage existing ICE motorcycle assets while making proactive investments. With a global sales network of 30,000 stores and enhanced online sales, Honda aims to maintain its position as the top seller in the electric vehicle era.

Medium- to Long-Term Targets

For global electric motorcycle sales, Honda aims to increase its target from 3.5 million units announced in 2023 to 4 million units by 2030. To achieve this, Honda plans to launch approximately 30 electric models in global markets by 2030, including those already announced.

Simultaneously, Honda will accelerate cost reduction efforts by utilizing scale advantages from ICE motorcycle production. The goal is to reduce the cost of completed motorcycles by approximately 50% by 2030 through battery standardization, procurement, modularization of body parts, and optimization of production and procurement.

To achieve these goals, Honda will invest approximately 500 billion yen by the Fiscal Year Ending March 31, 2031 and aims to achieve Rate of Sales (ROS) of 5% or higher for electric motorcycles by 2030, with a target of 10% or higher in the 2030s.

Five Strategies for Electrification

1. Product Strategy

In 2024, Honda will introduce a model equivalent to a 110 cc ICE motorcycle, equipped with two MPPs. This includes an India-specific model that maintains the practicality of mass-market models and a global model featuring advanced equipment such as In-Vehicle Infotainment (IVI). The global model will launch in Indonesia first, followed by sequential releases in Japan and Europe.

From 2025 onwards, Honda will be expanding the variety of electric motorcycles, including FUN models and plug-in rechargeable commuter models.

This will aim to increase our market share globally and establish ourselves as a leading company in electric motorcycles.

SC e: Concept

2. Electric Platform Strategy

In the short term, Honda will leverage existing ICE parts for rapid electric motorcycle development.

In the long term, to address diverse global needs, Honda will proactively apply knowledge gained from ICE motorcycle development to quickly and efficiently market a variety of electric motorcycles. We will modularize the battery, power unit, and body, and by sharing these modules, we will create cost advantages and offer a diverse range of variations.

3. Connectivity Strategy

One of the major advancements in electrification is connectivity. Building on Honda’s strengths developed with ICE vehicles, we will enhance comfort and convenience through connectivity. Additionally, we will offer electric motorcycles that continue to evolve after purchase through Over-the-Air (OTA) software updates, leveraging advanced software technology.

The 2024 battery-swapping model will feature “a proposal-type navigation function” for easy access to charging station information. Future models will use data from both ICE and electric vehicles to offer personalized features and experiences, advancing Honda’s unique connectivity.

4. Battery Strategy

Batteries are the cornerstone of electric motorcycles. Honda will strategically develop cell procurement and pack production allocation, primarily in Asia, to support both motorcycles and power products.

In addition to the Nickel Cobalt Manganese (NCM) used in the current models, we are accelerating the development of a battery system equipped with Lithium Iron Phosphate (LFP) cells, aiming for application in models released from 2025 onwards. By having a variety of batteries, each with different strengths and costs, we will be able to offer products that meet a wide range of needs.

We will also introduce models equipped with more advanced next-generation batteries around 2030. This will ensure stable supply, enhance product appeal and cost competitiveness, and promote further adoption and expansion of electric motorcycles.

5. Procurement and Production Strategy

For electric motorcycles production, Honda will maximize the use of existing ICE business assets to ensure cost competitiveness during the market entry phase (up to 2026). After 2026, in the business expansion phase, we will commence global production of electric motorcycles in dedicated factories optimized for electric vehicle production, aiming to achieve the sales target of 4 million units by 2030. These specialized factories will incorporate modular platform technologies and other innovations, reducing assembly line length by approximately 40% compared to existing factories, thereby enhancing efficiency and automation.

For procurement, to build a more competitive system, Honda will consider shifting from procuring finished parts to in-house processing, assembly, and logistics. The reevaluation of each step in the process will improve the cost competitiveness per finished vehicle.

Enhancing Adaptability to Environmental Shifts

In response to rising raw material and energy prices and increasing societal demands for environmental and safety standards, Honda is enhancing its resilience to adapt to these changes.

As the world’s No. 1 motorcycle manufacturer by market share, Honda is leveraging its scale while shifting its focus to growing markets such as India, Indonesia, and Brazil. This shift serves as an opportunity to restructure production bases and procurement frameworks, reduce costs and shorten development timelines through mass production, and develop catalysts that do not rely on high-cost materials. These efforts aim to enhance our ability to respond to market changes.

Looking ahead, Honda aims to streamline and integrate parts and improve development efficiency across the entire value chain to further strengthen its business structure.

Additionally, this includes ongoing efforts to reduce costs for both ICE and electric motorcycle components through unified parts planning in terms of standardization, procurement, and production technology.

Through these initiatives, Honda will maintain a highly efficient business structure and build a solid foundation to become a leading company in the area of electrification.