4.A Challenger Brand: Establishing Acura

Solidifying Honda’s Position in the Market

First generation Legend (1986 model) introduced exclusively for the ACURA channel

Honda continued to increase its share in the North American market by adding variety to its product lineup, with the introduction of the Prelude after the successful launch of Civic and Accord. One year after the launch of the Prelude in 1979, Honda’s annual automobile sales in the U.S. exceeded 370,000 units, but Honda had already set the next target: increasing annual sales to 1 million units by 1990.

To achieve this target, Honda had to address some issues related to the image of Honda cars. At the time, most American people viewed Honda cars as economical, value-for-money cars targeting families. However, to achieve its 1 million-unit sales target, Honda needed to add some high-performance and sporty models to its lineup.

To maintain the brand loyalty of customers who upgraded their entry-level Civic model to an Accord, Honda had to offer more upgrade options. To achieve this, a second brand oriented more toward luxury and high-end vehicles became necessary.

Meanwhile, Honda dealers, now totaling 1,000 in the U.S., were looking for opportunities to reinvest profits they had earned from their business. They would prefer to invest in Honda business, but in some states, including California, franchise laws prohibited the construction of more than one dealership of the same brand within a 10-mile range in order to protect a dealership’s business. So, the establishment of a second channel was eagerly awaited to offer an investment opportunity for Honda dealers. There was no time to spare. A new channel had to be established before baby boomers moved into the luxury car market. Due to the sharp appreciation of the yen the market was experiencing at the time, the sales prices of Honda vehicles were continuously on the rise. From a broad perspective considering the current situation, Honda made a decision to create a sporty, high-tech channel.

In March 1986, the first Acura channel opened full of dreams and hopes. This was before the launch of luxury vehicle brands by other Japanese automakers, such as Lexus and Infiniti in 1989. The name Acura was derived from the Latin word “acu,” meaning done with precision.

The Acura brand was off to a good start. The Legend, Honda’s first V6 model, was launched exclusively through the Acura channel as the first luxury car introduced by any Japanese automaker. The Legend featured performance and quality on par with established U.S. and European luxury brands with higher value for money, making it an ideal upgrade option for Accord owners. Another Acura model, Integra, also gained popularity for its sporty design and performance.

AHM executives requested Honda R&D to develop cars different from Honda. Acura only introduced “cars which are not Honda cars” based on the judgment of a committee AHM established which consisted of AHM executives, Acura dealers Dave Power, founder of J.D. Power & Associates and others.

The establishment of the Acura brand was an endeavor fraught with the utmost difficulty. The team had to address various issues, including the compliance with relevant laws, resolving issues related to contracts with existing dealers and the development of distinctive Acura cars. However, the Acura team overcame all such difficulties with the spirit of “We could never give up.”

ACURA dealer (1989)

Local Development and Production of Exclusive Acura model

in the U.S.

Honda R&D North America (HRA), Honda’s local R&D operations in the U.S., had been developing variant models exclusively for North America, such as the Accord Coupe and Civic Coupe, however, it was decided that HRA would develop the 1997 Acura CL exclusively for the Acura channel in North America.

The Acura CL became the first model developed completely by HRA while focusing on North American customers, and HAM’s East Liberty Plant began mass production of the model in February 1996. The Acura CL was well received by the market. Thanks to the R&D and production system and capability Honda had amassed over a long period of time in North America, a model fully developed and produced locally in the U.S. became possible in the 10th years since the founding of Acura brand. The lineup of locally developed and produced Acura models, such as the MDX, was subsequently expanded.

ACURA CL, HRA’s first development model.

Members of the first development team inspect the white body.

ACURA CL (1999 model), the beginning of subsequent ACURA local development and production models.

Acura Renaissance

The Performance Manufacturing Center (PMC)

The Performance Manufacturing Center (PMC)

With the downsizing of development investment due to the impact of the 2008 global financial crisis, it became difficult to achieve clear differentiation from Honda models and continue developing and introducing unique Acura models. As a result, the Acura brand struggled for a time, in terms of the innovativeness of products, completeness of vehicle features, and enhancement of brand appeal.

In 2016, with the launch of the second-generation NSX produced at the Performance Manufacturing Center (PMC) in Ohio, the Acura brand once again turned to the direction of pursuing outstanding performance. The “Precision Crafted Performance (PCP)” DNA which was used when the Acura channel was launched, made a comeback as the Acura brand slogan.

Also, in 2021, the Type S high performance variant was added to the lineup of TLX and MDX, and the Integra, which became popular in Acura's early days, was also brought back to the lineup. In fact, the model name, Integra, was brought back while making an exception to the rules to use a alphanumeric name for all Acura products.

It was truly an “Acura Renaissance.”

Moreover, to highlight the change in direction of the brand, Acura decided to participate in IMSA (International Motor Sports Association) endurance racing, and the Acura ARX-05 began competing in the LMP2-class in 2018. Partnering with one of the most prestigious racing teams, Team Penske, the team won the series championship for two consecutive years in 2019 and 2020. Since 2021, two Acura teams have participated in and won the 24 Hours of Daytona, one of the IMSA series races, for three consecutive years from 2021 to 2023.

The rebranding of Acura, mainly with the enhancement of its image as a performance brand, is making steady progress due to the combination of the strengthening of the Acura model lineup and the PCP brand appeal through motorsports activities.

ACURA won the Daytona 24-hour race in 2023 for the third consecutive year. (photo: ARX-06)

5.Maximizing the Joys with Customer Satisfaction

Activities and Dealing with the Gradual Appreciation of

the Yen

Striving for Autonomy as a North American Company

In the U.S., businesses placed importance on customer satisfaction (CS), and many companies were conducting an annual customer survey based on the Customer Satisfaction Index (CSI). As a result, CSI became recognized as an objective standard for assessing customer satisfaction.

AHM had been conducting a CSI-based survey every year since 1981, and AHM sales and service divisions worked on CS initiatives to maximize the “Joy of Buying” among “The Three Joys” of Honda. As a result of such initiatives, in 1986, Honda was ranked No. 1 in the U.S. in overall customer satisfaction in a nationwide car user survey conducted by J.D. Power.

Commenting on being named No. 1 in CSI in the U.S. in 1986, then Global CEO Tadashi Kume said, “In the midst of a tough economic climate, the survival race among automakers is intensifying around the world, but Honda's Fundamental Belief is to satisfy customers based on the high quality of our products. We believe that we can pave the way to the future by striving to ensure that customers are satisfied with Honda products and the Honda dealers where they buy Honda products and come to love Honda based on their satisfactory experiences.”

However, after a while, there was a growing tendency for customers to drift away to other brands despite the fact that AHM maintained a high level of CS.

Evolving Customer Satisfaction (CS) into

Lifetime Owner Loyalty (LOL)

In 1995, AHM formed a project team to investigate the relationship between CS and purchasing products from alternative brands. One of the reasons for the brand disloyalty was an issue related to the product lineup at the time. Honda was moving forward with plans to strengthen its lineup of SUV models and Acura brand models to better accommodate market changes, but to do so, AHM first needed to increase customer willingness to purchase Honda and Acura products.

Honda viewed the flow of customer actions of an automobile purchase based on the concept of the “ownership cycle” which consists of the actions of purchase, ownership, then to revisit and repurchase. The survey data indicated that this cycle generally took approximately five years, which meant that typical customers make seven automobile purchases over the course of their lifetime. Based on this understanding, Honda came up with the concept of “Lifetime Owner Loyalty (LOL).”

AHM reaffirmed that a low customer satisfaction level during the purchase process and after-sales service process had a negative impact on brand loyalty. Based on this reaffirmation, Honda formulated specific measures to improve each process, and dealers and AHM worked together to maximize LOL.

In 2003, AH launched a program called EXCELL (Exceeding Customer Expectation Levels for Life) which was designed to encourage lifetime owner loyalty by exceeding customer expectations. Under this initiative Honda and Acura dealers took necessary measures to link CS improvement to LOL. This proved very effective, and both the Honda and Acura brands saw a steady increase in brand loyalty from their customers. To be more specific, under the EXCELL initiative, the true causes of customer dissatisfaction from dealer after-sale service treatment were determined for each item, and fast-acting remedies were specified and implemented at each dealer.

Other similar initiatives have been implemented since the EXCELL program, now generally called “Post Service Follow Up” and being implemented by Honda and Acura dealerships today.

At the time of a new model introduction, many customers visit dealership locations. At such time, if all divisions involved in the “ownership cycle,” including sales, finance/insurance (F&I), parts and service divisions, work in cooperation, they can give a new and positive influence on customers’ purchase and ownership experiences. Only through such a contribution and the collective strength of Honda and its dealers, can Honda strengthen the attractiveness of the brand that makes more people love Honda and thus enhance the customer’s brand loyalty.

Honda’s initiatives to improve customer satisfaction and profitability over the customer’s lifetime have further advanced since then. The series of customer experience processes – studying candidate products, talking to dealers and signing a contract, purchasing a product, receiving after-sales service, and then upgrading - have been organized chronologically and systematized as a “customer journey map” to show how customers feel when they come in contact with Honda and Honda dealers.

By interacting with customers systematically and at the appropriate time in each process, customer satisfaction will be enhanced and a deep relationship of trust can be established between Honda, Honda dealers and the customer, which would lead to the enhancement of the customer’s brand loyalty. Currently, such a "Customer Interaction Model" (a model that indicates effective customer contact and treatment) is being developed and applied in practice.

Another important factor in achieving LOL is Honda’s ability to maintain used car prices at appropriate levels. For most people, automobiles are durable consumer goods with the second largest asset value after their house. When customers try to sell their cars in the market, if the resale price is low, the trade-in value would also be low. When this happens, customers lose trust in the automaker. Conversely, if the trade-in value is high, the balance amount the customer needs to pay to purchase the next vehicle would be low, which increases the likelihood that the customer would choose another Honda vehicle.

The way to maintain used car prices high is clear. First, increase the quality of the product itself. Second, is not to discount. However, this is easier said than done, and most automakers haven’t been able to follow this simple rule. For example, in order to secure a certain production volume, some automakers build up inventories and then sell their products at a discount by offering large sales incentives. By repeating this, some automakers have lost the trust of their customers. Honda has a history of keeping incentives low and has rarely sold large quantities to rental car companies in order to secure a large number of the new vehicle registrations. Instead, Honda has always focused earnestly on sales to individual customers. In fact, for six consecutive years from 2004 to 2009, Honda was named the top performer in the U.S. ALG Residual Value Awards by ALG (Automotive Lease Guide), the benchmark for automobile residual values in the U.S. Honda has continued to perform consistently at or near the top of the ALG awards. For 2022, Honda earned the ALG Residual Value brand award for the Mass Market segment, including three model level awards.

Gradual Appreciation of Yen

After World War II, the yen-dollar exchange rate was fixed at 1 dollar = 360 yen based on the price stability and fiscal tightening policy imposed by the GHQ-SCAP (General Headquarters, the Supreme Commander for the Allied Powers), the so-called “Dodge Line” announced in 1949. Subsequently, Japan rapidly recovered its industrial strength and began to generate substantial profits from exports. On the other hand, the U.S. experienced a decline in economic power due to events such as the Vietnam War and trade wars, and trust in the U.S. dollar was further diminished by the unilateral suspension of the convertibility of the U.S. dollar into gold as a part of the so-called "Nixon Shock." In light of these circumstances, in 1971, the U.S dollar was devaluated to 308 yen to the dollar. In 1973, after further devaluation of the dollar, the shift was made from the fixed exchange rate system to a floating exchange rate system. From there, the yen gradually appreciated, and following the Plaza Accord in 1985, it surged to the 120-yen range per dollar around 1988.

Local Production Represents the Foresight of Honda Leaders

who Came Before Us

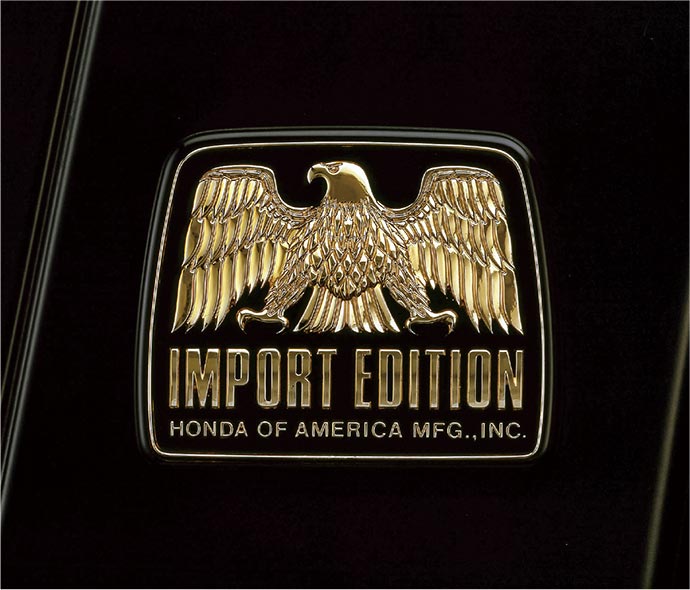

Accord Coupe’s emblem

Accord Coupe’s emblem

Like many other businesses, Honda felt a sense of crisis due to this yen appreciation. In 1987, then Honda Global CEO Tadashi Kume said: “The appreciation of the yen has put many Japanese companies in panic mode to expand their business outside Japan; however, Honda's policy to building products close to the customer remains steadfast and is becoming increasingly important. In fact, our factories outside Japan, such as those in Ohio, are playing a crucial role in supporting Honda in the face of this yen appreciation. We must pay tribute to the foresight of Honda leaders who came before us.”

However, despite the fact that Honda was leading other automakers in terms of overseas production volume, the proportion of export sales to total sales for Honda was by no means low. Therefore, the yen appreciation significantly squeezed profit, and Honda faced numerous challenges such as intensifying competition in Japan among domestic automakers who tried to secure profit in Japan amidst the difficulties in the export market, while also needing to deal with accelerating technological advancement and consumers’ declining interest in material possessions.

“By overcoming these challenges and continuously growing our business in each region around the world as a company that local people relate to, we can become a truly global company," said Kume, boosting the morale of Honda associates.

On September 17, 1987, Honda announced the “Five-Part Strategy for North America,” which consisted of five strategies Honda would pursue toward the further enhancement and advancement of its corporate activities in North America. This included the enhancement of development and production systems and capabilities in the U.S., increased local parts procurement and plans for exports from the U.S.

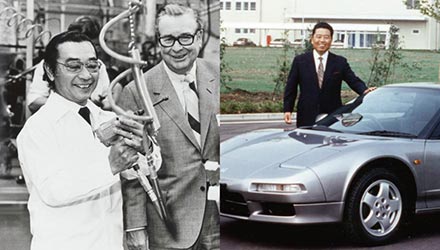

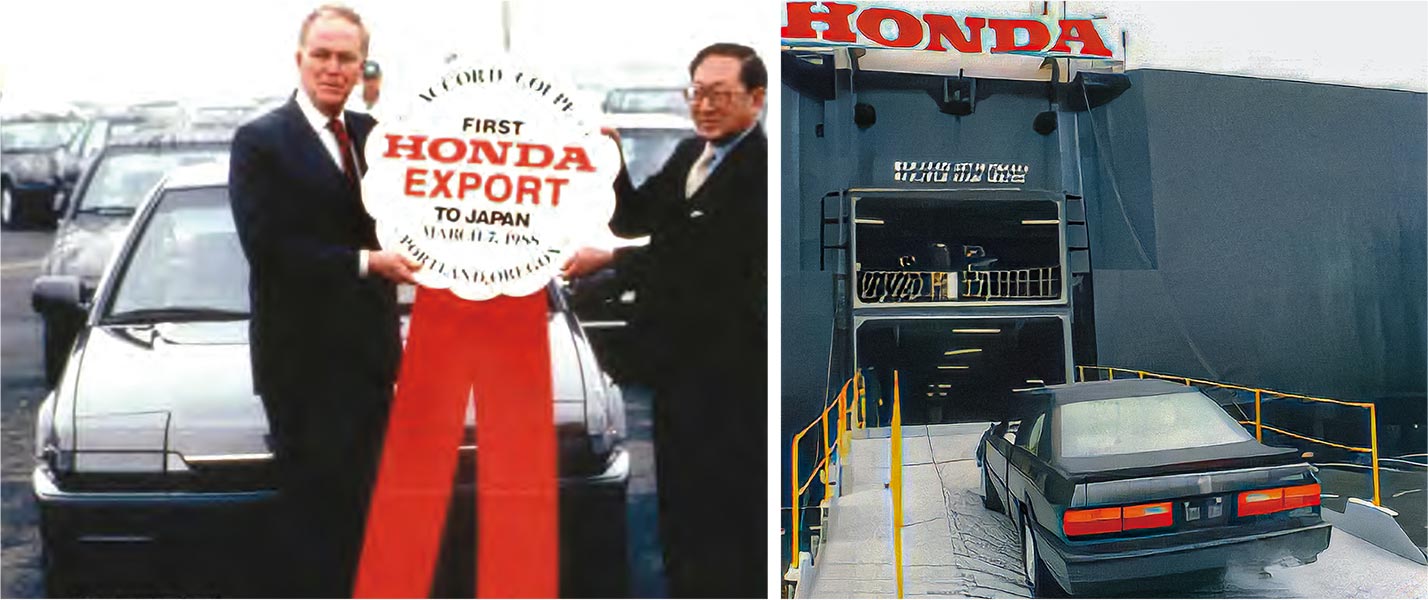

Based on this announcement, in April 1988, the Accord Coupe produced by HAM went on sale in Japan as an imported model. This model featured an eagle emblem on the center pillar, symbolizing its American origin, and was initially kept as a left-hand drive vehicle, setting it apart from the Japan-made Accord and earning favorable reviews. This exporting of Accord from the U.S. coined the term “reverse-import” in Japan. In the same year, import sales of Gold Wing, the large-sized motorcycle made by HAM, also began in Japan.

Subsequently, in 1997, production of the Accord developed exclusively for the North American market by HRR began at HAM. While the Japanese version of Accord Sedan had a width of 1,695 mm to qualify for the 5-number size (small-size) vehicle classification in Japan, the 6th generation Accord developed with an eye toward sales in North America featured a stately vehicle body with a width of 1,786 mm. This model represented the successful collaboration among autonomous development, production and sales operations Honda had built in North America and was very well received in the market as the first Accord model truly developed and produced in the U.S.

HAM-produced Accord Coupe, the first model exported to Japan.

March 1988: Export of the Gold Wing GL1500 to Japan begins.

Accord V6 Sedan (1998 model)

Striving to Become an Autonomous North American

Company

The appreciation of the yen further accelerated. By around 1995, the exchanged rate surpassed 100 yen to a dollar and reached the 80-yen range.

Nobuhiko Kawamoto, who had been serving as Global CEO since 1990, issued a manifesto outlining his view of the situation and what he expected of Honda associates:

“In the face of these drastic and substantial changes, anything is possible. The appreciation of the yen has been posing increasingly difficult challenges for us. Despite the considerable efforts being made by each division, the speed and magnitude of the yen’s appreciation have surpassed our efforts.

We must place greater emphasis on addressing this issue, otherwise we have a risk of losing our foundation as an export company. I have a sense of crisis at such a level.

Honda has been working on various measures to rationalize our operations, including the improvement of production efficiency of our factories. To overcome this difficult situation with the collective efforts of everyone who works for Honda, we must now, more than ever, think out what we need to do with ongoing reform of our business structure, using techniques like TQM.*4 And once we make decisions, we must continue pursuing them sincerely and steadily without hesitation. This is the most important thing, and I want all of you to understand that there is no better way than that.”

Kawamoto saw the strong yen as an opportunity to accelerate the autonomy of Honda’s automobile business in North America. He also believed that this would be an opportunity for Honda in Japan to break away from the business structure with high dependency on exports and the North American market.

In September 1993, Kawamoto made an internal announcement to convey the message that Honda would further pursue the autonomy of its automobile business in North America:

“Honda has been ahead of other automakers in pursuing local production and local development of products to localize our operations in North America. As a result, we have been able to conduct our business while avoiding the impact of currency exchange fluctuations to a certain extent. By leveraging this strength, we will enhance the lineup and cost competitiveness of our local production to take another step toward the enhanced autonomy of North American operations.

In Japan, we must strengthen our domestic sales and transform our business structure in the way that we can breakaway from the dependence on the U.S. market.

If Honda operations become more autonomous in each region of the world, and our four regions work toward the establishment of a mutually complementary system where division of work is achieved, we can become a resilient global company which can flexibly address any changes including currency exchange fluctuations.”

- Total Quality Management