Business Expansion and Local Procurement

In the early 1990s, Honda's manufacturing was once again facing a major turning point due to significant exchange rate fluctuations (from 132 yen to the dollar in 1992 to 83 yen in 1993) and intensified competition from European and U.S. manufacturers. Around 2000, China’s entry into the World Trade Organization (WTO), a series of mergers and acquisitions among automakers, and a number of scandals related to product quality occurred. In addition, the rapid spread of the Internet and the arrival of the information society, in which information instantly travels around the world, heightened the needs of consumers.

The environment surrounding the automobile business entered a period of large change and chaos, with de-industrialization as manufacturing bases moved overseas, and intensifying competition due to the formation of new corporate groups through multiple automobile manufacturers merging.

Honda set out to transform its corporate structure to be more resilient to fluctuations and to prepare for future growth, and pushed ahead with independence in four regions, adding Asia Pacific to Japan, North America, and Europe, in its aim to beat the competition and set up a solid revenue base. The Purchasing Department also supported the independence of each region’s purchasing and worked to realize optimization of parts between the regions.

In cooperation with suppliers, Honda quickly localized management of production, parts, and personnel with the support of the core factory, aiming to establish a business foundation rooted in the local regions. It also strengthened its business structure so that business partners who had established overseas bases could be competitive on a global scale.

For example, the Japanese QD (Quality Delivery) unit visited each country and deployed “Operation Swallow,” aiming for a high level of quality and stable parts supply. In addition, automobile parts produced in China, Asia, and other regions were used for the Fit and k-cars in Japan. In China, in particular, Honda’s early efforts to cultivate automobile parts suppliers were particularly successful, leading to the rapid start-up of local production of automobiles at former GAC Honda Automobile Co., Ltd. (later to become Guangqi Honda).

In motorcycles, global procurement from parts suppliers in China and Southeast Asia progressed in earnest. This led to the “C8G3 Strategy,” Honda’s maker layout in which approximately 80% of parts for commuter models were procured from the three companies judged to be the best on a global scale. By combining this with the standardization of model components*1, cost competitiveness was dramatically enhanced, contributing in large part to achieving a large share in the motorcycle market in ASEAN*2 countries and India.

This series of purchasing efforts led to a high level of QCD stability in the supply of parts to production bases around the world, and contributed greatly to the realization of the “Made by Global Honda” philosophy of providing customers with the same quality product regardless of where it was manufactured.

- Units of multiple parts grouped by function

- Association of South-East Asian Nations

Aiming for Truly Global Procurement

Regional models (from top) Brio, Amaze, and WR-V.

Regional models (from top) Brio, Amaze, and WR-V.

In the 2010s, Honda shifted from its traditional business of producing and selling models such as the Civic, Accord, and CR-V in developed countries, to developing, producing, and selling models that reflect market needs in each country and region.

The number of region-specific models such as the Brio in ASEAN countries, the Amaze in India, and the WR-V in Brazil increased, and parts for each country-specific model expanded as well. As a procurement measure, Honda reinforced the purchasing function in each region, and launched a “Lowest Price Strategy” to find the lowest-priced parts and suppliers in each region. Efforts were made to find competitive parts and local manufacturers in Thailand and China, and utilize them not only in the region but also in Japan and North America. As a result, inter-regional imports and exports of parts were stimulated.

While the “Lowest Price Strategy” led to the discovery of low-cost parts and new suppliers, and contributed to earnings in the region, the need to request the same parts from multiple suppliers on a global basis resulted in a marked increase in the design process for both Honda and its suppliers. With the need to expand business and increase speed to keep up with changes in the social environment and customer values, it had become increasingly important to determine and achieve a balance between design man-hours and cost in procuring parts globally.

In order to correct this distortion for automobiles, build a stronger foundation for existing business, and create a foothold for the next era, Honda shifted from its long-standing “cooperative management system” in which each of SEDB (Sales,Production/Engineering,Development and Buying) are independent, to a “unified management system” in which SEDB functions are placed under respective motorcycle and automobile business operations.

In conjunction with this company-wide reorganization, purchasing also underwent major reform. This was the fusion of the purchasing cost division, which leads the maker layout, and the design division. By integrating purchasing and design, Honda believed that the suppliers' production sites needs could be reflected in the early planning stage of model development, maximizing their development efficiency. In other words, Honda aimed to front-load*3development activities. By having purchasing staff with knowledge of the customer’s site work in cooperation with design staff, Honda had developed an initiative to review product features and requirements that could hinder efficient development by the suppliers.

Specifically, Honda began “collective planning” for future global models, to expand the use of common parts across models achieving economies of scale, while also realizing product diversity.

Collective planning was an unprecedented change in direction, involving the long-term use of existing platforms, the creation of high product quality products with minimal changes, the setting of specifications that could be bundled in volume, and the integrated planning of vehicle packaging, parts specifications, and parts costs for four global models.

Furthermore, in conjunction with collective planning, initiatives to improve manufacturing at the suppliers, the origin of Honda’s purchased parts, continued. Honda engaged in “Monozukuri Reform Activities” to create high-quality plans together with suppliers, in order to eliminate factors that Honda would cause to hinder development, eliminate waste caused by Honda and suppliers, and innovate specifications and manufacturing. Through these activities, Honda evolved manufacturing in the supply chain, including suppliers, and the engineering chain from development to mass production, as well as realize Monozukuri evolution and stable production in its overall operations.

While pushing ahead with these major reforms, Honda also needed to take measures to address various parts supply risks. Back in 2004, when the Chuetsu Earthquake hit Niigata Prefecture, Honda was faced with a situation in which the supply of analog meter pins stopped. Meter pins require extremely high precision, and the majority of the world’s analog meter pins were manufactured in the Niigata area. At the time, efforts to avoid parts supply risks were limited to identifying parts that were being mass-produced in one location, and building up inventory.

In 2007, the Niigata Prefecture Chuetsu-Oki Earthquake occurred. This time there was a crisis in the supply of piston rings, and the entire company, including Honda R&D, was mobilized to deal with the situation. Although Honda was able to minimize the impact of the earthquake on production by deploying manpower, it began to consider how to prepare for supply risks, believing that the impact could be minimized and that there had to be steps that could be taken before an earthquake occurred.

While frantically dealing with supply risks, a rapid succession of unforeseen events occurred that had a major impact on parts supply, including the Great East Japan Earthquake, flooding in Thailand, and a pandemic.

After the Great East Japan Earthquake in 2011, purchasing members moved from Tochigi, which was severely damaged, to Asaka, Sayama, and Suzuka, and repeatedly discussed with internal and external parties, including suppliers, whether there would be any problems with parts supply and when production would be able to resume. A disaster in one country could disrupt the supply chain worldwide, affecting Honda’s production bases everywhere. For example, damage to material-related plants was reported as a result of the earthquake. Upon receiving this report, Honda confirmed that many of its Tier 1*4 suppliers used materials from these plants, and were severely affected. Honda was not aware of these connections, and was forced to manage the supply chain more precisely. Since restoration of the material plant was impossible in the short term, the purchasing department and Honda R&D coordinated to develop the affected parts using alternative materials as an emergency response. The efforts made at that time have been utilized since, and a system was established to immediately develop parts in cooperation with Honda R&D in the event of an emergency.

In addition, during the flooding in Thailand in 2011, the supply of semiconductor chips was disrupted, and an inspection of the global supply network revealed that there was insufficient understanding of what was produced in each country, and what commercial channels were used to send these parts to which countries for assembly. In 2011, Honda needed to call each supplier to confirm the supply status of parts, which caused a great deal of confusion.

In response, Honda introduced SCRKeeper (Supply Chain Risk management) as one of its initiatives to understand the damage to its supply chain in the event of a large-scale disaster. SCRKeeper allows suppliers to register their components in detail so that, in the event of a disaster, they can immediately identify which components are likely to become bottlenecks. With the introduction of this system, Honda was able to quickly respond to the Kumamoto earthquake in 2016, minimizing the impact on production due to parts supply risks.

The global outbreak of COVID-19 from 2020 caused production and logistics disruptions, including the inability to operate factories due to labor shortages and restrictions on the use of ports and vessel navigation, and prevented the supply of a variety of parts and materials to meet the production volume requirements of each country. It was clear that conventional supply risk responses could not handle a global scale disaster. In order to strengthen the global supply chain against various supply risks that may occur in the future, Honda continued to study the further evolution of its purchasing, following the integration of the purchasing cost department and the design department in 2020.

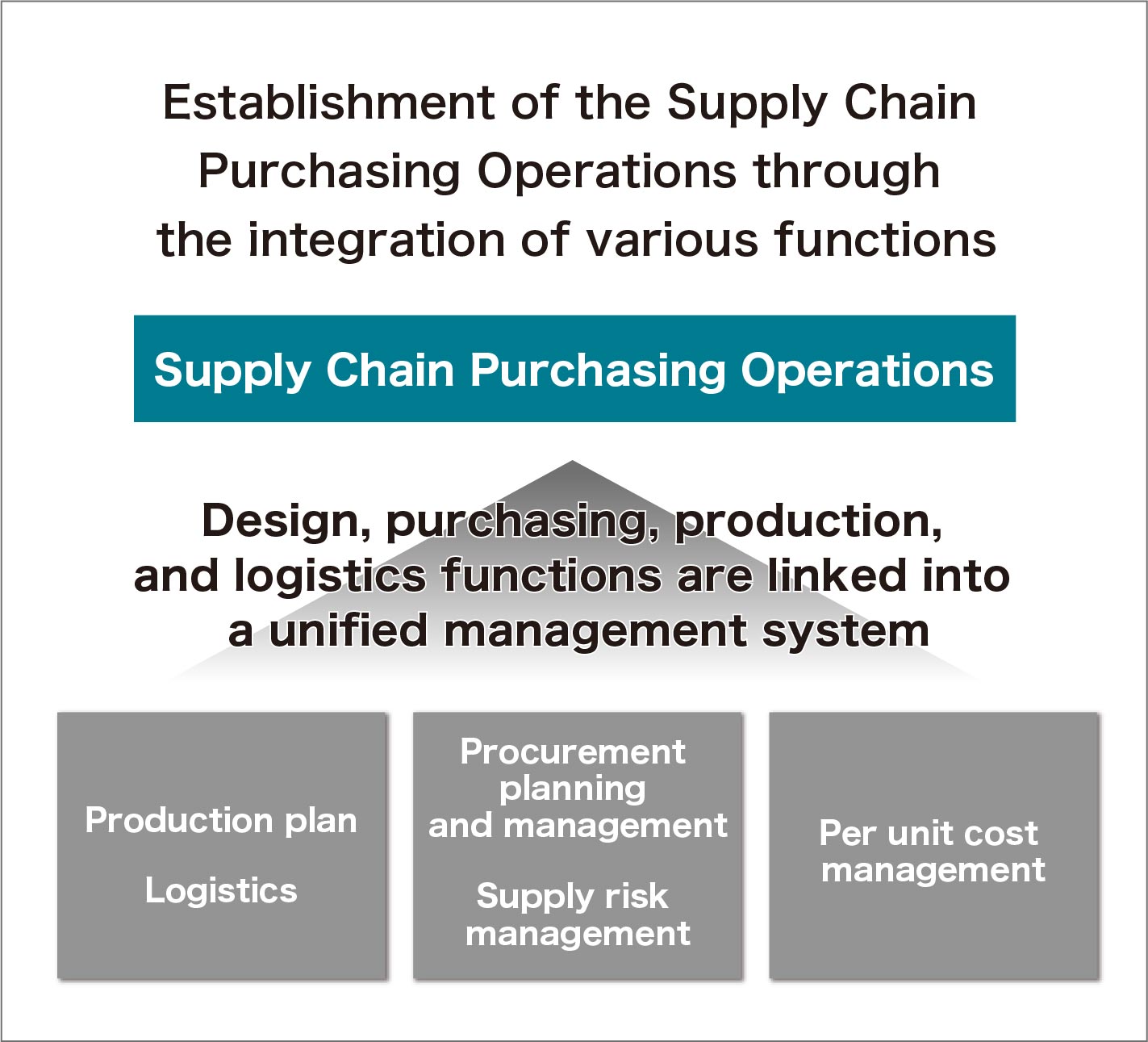

Until now, Honda’s purchasing department had been securing parts and materials through coordination with suppliers based on the number of units in the production plan, which was based on the requests of the sales department. In other words, it was a production-sales system that followed the sales plan. However, after taking various risk countermeasures, Honda shifted to a resource production-sales process that placed more emphasis on securing parts and materials. In anticipation of the implementation of the raw resource sales process, the Supply Chain Purchasing Operations was established in 2022, integrating the purchasing and supply chain management (SCM). This made it possible to formulate and rapidly implement business strategies for the entire automobile business, and the Supply Chain Purchasing Operations could address supply chain disruptions with a flexibility, including logistics, by concluding new contracts with suppliers to secure parts and materials based on an understanding of each department's needs.

Supply Chain Purchasing Operations

When COVID-19 led to shortages of various materials, including semiconductors, members of the Supply Chain Purchasing Operations worked tirelessly with the design team and suppliers to secure materials and semiconductors, in order to deliver products to customers as quickly as possible. The experience of numerous disasters, beginning with the Niigata Chuetsu Earthquake in 2004, allowed Honda to return to the basics of delivering products to customers, and establishing a new system in which Honda’s departments and suppliers collaborated from the planning stage, rather than being merely purchasers and suppliers. This new system has made it possible to respond to major disasters such as a pandemic in a cohesive manner. Collaboration across the purchasing and SCM domains was the driving force to overcome these crises.

Honda’s purchasing, which originated from “Do not stop the conveyor belt,” is now working to build an operational structure to transform the automobile business into one that responds to the era of electrification and digitalization, as well as to respond to global and environmental changes. Although powertrains may change, cars will still be built with parts procured by the purchasing department. To achieve carbon neutrality, which is the most important issue now, Honda’s purchasing continues to evolve together with its suppliers, from the procurement of raw materials to their disposal.

- Processes that can be accelerated should be carried out in the initial stages. In this case, it refers to making all design modifications well before mass production begins.

- Tier 1 suppliers that deliver directly to automobile manufacturers.