Notice regarding the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation, Showa Corporation, and Nissin Kogyo Co., Ltd.

October 30, 2019, Japan

Toshiaki Higashihara, Representative Executive Officer, President & CEO

Hitachi, Ltd.

(Securities code 6501)

Takahiro Hachigo, President and Representative Director

Honda Motor Co., Ltd.

(Securities code 7267)

Brice Koch, President & CEO

Hitachi Automotive Systems, Ltd.

Keiichi Aida, Representative Director and Director President

Keihin Corporation

(Securities code 7251)

Nobuyuki Sugiyama, Representative Director and Director President

Showa Corporation

(Securities code 7274)

Yasushi Kawaguchi, Representative Director President

Nissin Kogyo Co., Ltd.

(Securities code 7230)

Hitachi, Ltd. (TSE: 6501, “Hitachi”), Honda Motor Co., Ltd. (TSE: 7267, “Honda”), Hitachi Automotive Systems, Ltd. (“Hitachi Automotive Systems”), Keihin Corporation (TSE: 7251, “Keihin”), Showa Corporation (TSE: 7274, “Showa”), and Nissin Kogyo Co., Ltd. (TSE: 7230, “Nissin”) hereby announce that these six companies have each resolved in their board of directors meetings held today that, on the precondition that permits and licenses, etc. can be obtained from the respective countries’ relevant authorities, including notification or approvals for business combination to or by the respective countries’ competition authorities, (a) Honda will conduct tender offers targeting the common shares of Keihin, Showa, and Nissin (collectively, the “Tender Offer”), (b) Honda will make each of Keihin, Showa, and Nissin its wholly-owned subsidiary (collectively, “Making the Target Companies Wholly-Owned Subsidiaries”), and (c) Hitachi Automotive Systems, Keihin, Showa, and Nissin will conduct an absorption-type merger in which Hitachi Automotive Systems will be the ultimate surviving company and Keihin, Showa, and Nissin will each be an ultimate disappearing company (the “Absorption-type Merger”), and will conclusively conduct a management integration (the “Integration”) to strengthen development and distribution of global and competitive solutions in the CASE area. These six companies have also entered into a basic contract regarding management integration (the “Basic Contract”).

Section I. Purpose, etc. of the Integration

1. Purpose and Background of the Integration

Currently, the automobile and motorcycle industries are facing a once-in-a-century revolution, and in the situation where they need to reduce environmental load and traffic accidents in addition to further improving comfort, competition is intensifying in fields such as electrification, autonomous driving, and connected cars, which are the core of future automobile and motorcycle systems. In these circumstances, suppliers are also required to expand their product lines and provide comprehensive solutions by combining software.

The surviving company after the Absorption-type Merger (the “Integrated Company”) will be a global mega-supplier of automobile and motorcycle systems with consolidated revenue scale of 1.7 trillion Japanese yen. This merger will enable combination of the respective advanced technologies of Keihin’s powertrain business, Showa’s suspension business and steering business, and Nissin’s brake system business with the strength of Hitachi Automotive Systems’ three core businesses, namely powertrain systems, chassis systems, and safety systems. Such combination will establish competitive technologies and solutions, which will be supplied to global customers by utilizing the economies of scale.

Specifically, the Integrated Company will contribute to the prevention of global warming by reducing CO2 gas emissions through electrified products and also to the realization of a “zero accident society” through Autonomous Driving and Advanced Driver Assistance System, and together provide a stress-free transportation experience, by gathering the vehicle control technologies of the six companies.

Furthermore, Hitachi will support the Integrated Company in contributing to the improvement of safety and mobility services, particularly in the field of connected cars, by utilizing digital technologies such as Lumada (Note 1) solutions.

In this way, the Integrated Company will aim to realize a safe and comfortable society and to expand people’s joy of transportation, and will also contribute to the development of the automobile and motorcycle industries.

(Note 1) Lumada: A collective term for solutions, services, and technology that utilize Hitachi’s futuristic digital technology for creating value through customer data and accelerating digital innovation.

Specific synergy effects of the Integration that are expected to occur in the Integrated Company are as stated below.

(i) Management foundation, technology development

By gathering and optimizing engineering resources, technology development will be accelerated in fields that are expected to grow, and management will be accelerated and become more effective. Products and cost competitiveness will also be strengthened due to expansion of business scale, synergies in the area of manufacturing, and mutual utilization of global bases.

(ii) Electric powertrain area

By integrating Honda’s and Keihin’s small single-unit structure and high efficiency energy management technology and Hitachi Automotive Systems’ material technology and production process, the development capability of drive units will be strengthened.

(iii) Chassis area

Through an amalgamation of Honda’s human engineering and electronic stability control technology, Showa’s and Nissin’s advanced hardware technology, and Hitachi Automotive Systems’ chassis control and high redundancy technology, system development with high reliability will be possible, which will be required in the age of autonomous driving, such as advanced integrated chassis control systems.

(iv) Autonomous Driving/Advanced Driver Assistance System area

Realization of advanced systems identification technologies regarding autonomous driving, such as external sensing technology and predictive AI technology, by an integration of the technologies of the six companies.

2. Details and Schedule of the Integration

(1) Details of the Integration

(a) About the Tender Offer

As part of a series of transactions for the Integration, to make Honda obtain all common shares of Keihin, Showa and Nissin (however, except for Keihin, Showa, and Nissin shares owned by Honda and treasury shares owned by Keihin, Showa, and Nissin, respectively; collectively, the “Three Target Company Shares”), and to make each of Keihin, Showa and Nissin Honda’s wholly-owned subsidiary, the six companies have agreed to conduct a Tender Offer targeting each of the Three Target Company Shares. The precondition of the commencement of this Tender Offer is satisfaction of certain matters such as obtaining permits and licenses, etc. from the respective countries’ relevant authorities, such as licenses regarding notifications of business combination by respective countries’ competition authorities.

The board of directors of each of Keihin, Showa and Nissin have each obtained a written report from a special committee established in each company as an advisory body for the board of directors; and by a unanimous vote of all directors who participated in the resolution held today, they expressed their opinion as of today to support the Tender Offer at the commencement of the Tender Offer and resolved to recommend to the shareholders of Keihin, Showa, and Nissin to tender in the Tender Offer.

For the details of the Tender Offer, please refer to “Notice regarding the Scheduled Commencement of the Tender Offer to Make Keihin Corporation (Securities Code: 7251) a Wholly-Owned Subsidiary in connection with the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation, Showa Corporation (Securities Code: 7274), and Nissin Kogyo Co., Ltd. (Securities Code: 7230),” “Notice regarding the Scheduled Commencement of the Tender Offer to Make Showa Corporation (Securities Code: 7274) a Wholly-Owned Subsidiary in connection with the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation (Securities Code: 7251), Showa Corporation, and Nissin Kogyo Co., Ltd. (Securities Code: 7230),” and “Notice regarding the Scheduled Commencement of the Tender Offer to Make Nissin Kogyo Co., Ltd. (Securities code: 7230) a Wholly-Owned Subsidiary in connection with the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation (Securities Code: 7251), Showa Corporation (Securities Code: 7274), and Nissin Kogyo Co., Ltd.” announced by Honda dated today (collectively, “Press Releases for Commencement of the Tender Offer”), respectively. For the details of the opinions by Keihin, Showa, and Nissin for the Tender Offer, please refer to “Notice of Position Statement regarding the Scheduled Commencement of the Tender Offer by Honda Motor Co., Ltd., an Affiliate, for the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation, Showa Corporation (Securities Code: 7274), and Nissin Kogyo Co., Ltd. (Securities Code: 7230),” “Notice regarding Expressing Opinion to Support the Scheduled Tender Offer for the Company’s Shares by Honda Motor Co., Ltd. (Securities Code: 7267) and the Recommendation of the Tender thereto,” and “Expression of Opinion Regarding Plan to Commence Tender Offer for Company Shares by Honda Motor Co., Ltd. and Notice of Closing of Basic Contract Regarding Management Integration,” respectively, announced by Keihin, Showa, and Nissin dated today.

(b) About Making the Target Companies Wholly-Owned Subsidiaries

If Honda cannot obtain all ordinary shares of Keihin, Showa and Nissin that the Tender Offer has been completed for, then Honda is scheduled to implement a series of procedures to make Honda the sole shareholder of shares of Keihin, Showa, and Nissin. For details, please refer to the Press Releases for Commencement of the Tender Offer.

(c) About the Absorption-type Merger

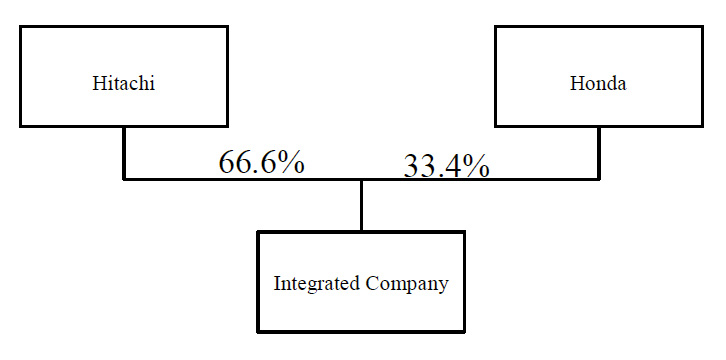

After the Tender Offer and Making the Target Companies Wholly-Owned Subsidiaries, the Absorption-type Merger of Hitachi Automotive Systems (a wholly-owned subsidiary of Hitachi) as the ultimate surviving company of the absorption-type merger and Keihin, Showa, and Nissin as the ultimate disappearing companies in the absorption-type merger will be implemented. Honda and Hitachi have agreed in the Basic Contract that in the Absorption-type Merger, common shares of the Integrated Company will be allotted to Honda as the consideration for the merger, in a merger ratio where the number of voting rights of the Integrated Company held by Hitachi and Honda will account for 66.6% and 33.4% of the number of voting rights held by all shareholders of the Integrated Company, respectively.

Furthermore, the ratio of the total share value of Keihin, Showa, and Nissin as of the effective time of the Absorption-type Merger to Hitachi Automotive Systems’ share value does not necessarily correspond to the above merger ratio. Given the above, sometime between completion of Making the Target Companies Wholly-Owned Subsidiaries and the effective time of the Absorption-type Merger, in order to have the ratio of the total share value of Keihin, Showa, and Nissin to Hitachi Automotive Systems’ share value correspond to the above merger ratio, the share values of Keihin, Showa, and Nissin will be adjusted through acquisitions of treasury shares by Keihin, Showa, and Nissin.

(d) About Relevant Restructurings

In connection with the Integration, Hitachi Automotive Systems is scheduled to obtain the shares of the relevant companies of the Hitachi Automotive Systems Group directly held by Hitachi, by the effective date of the Absorption-type Merger.

Furthermore, Keihin plans to assign its company’s air-conditioner business, which has business operations different from the Integrated Company, to a third party by the effective time of the Absorption-type Merger, but the target of the assignment and the consideration amount are yet to be decided. With regard to such assignment, please refer to “Notice Concerning Scheduled Transfer of Air Conditioning Business” announced by Keihin dated today.

Showa operates a car dealership business through Honda Cars SAITAMAKITA (“Honda Cars SAITAMAKITA”), a wholly-owned subsidiary of Showa which has business operations different from the Integrated Company, and it plans to assign the shares of Honda Cars SAITAMAKITA to a third party by the effective time of the Absorption-type Merger, but the target of the assignment and the consideration amount are yet to be decided.

As Nissin has announced in the “Notice Regarding Dissolution of Joint Venture Companies (Equity Method Affiliates) and Share Acquisition (Making Such Companies Subsidiaries)” dated today, Honda and Nissin have entered into a share transfer agreement with Veoneer AB, a wholly-owned subsidiary of Veoneer, Inc. (the joint venture partner of Nissin), where Honda and Nissin will jointly acquire all shares of Veoneer Nissin Brake Systems Japan Co., Ltd. (“VNBJ”) (Nissin’s equity-method affiliate) and VEONEER NISSIN BRAKE SYSTEMS (ZHONGSHAN) CO., LTD. (“VNBZ”), which are Nissin’s equity-method affiliates held by Veoneer, AB.

(2) Overview of the Integration

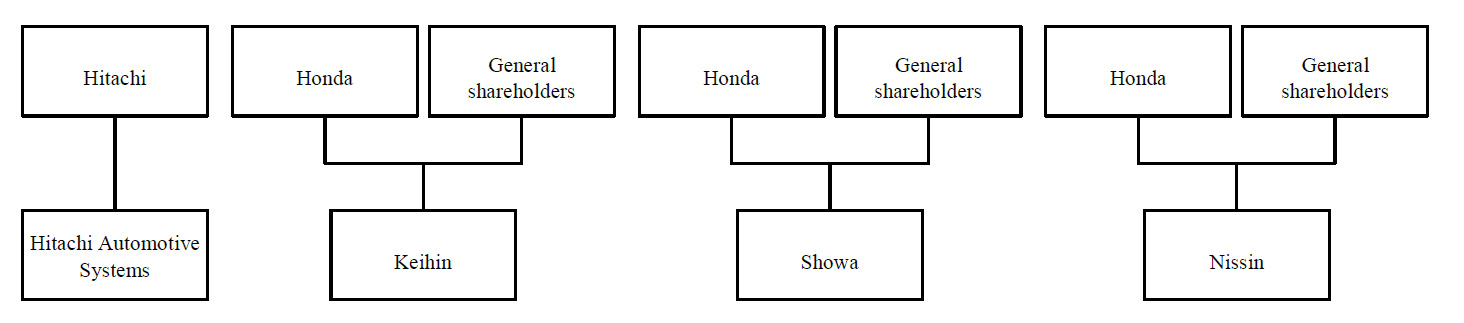

<Current State>

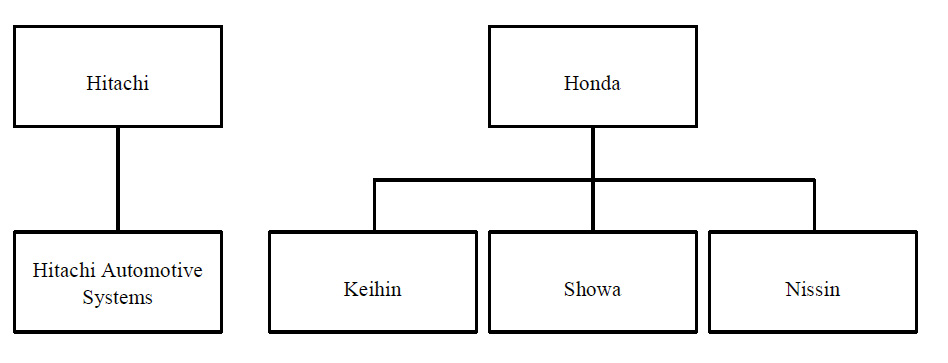

<After Honda makes each of Keihin, Showa and Nissin its wholly owned subsidiary>

<After establishment of the Integrated Company*>

* Absorption-type Merger of Hitachi Automotive Systems as the ultimate surviving company and Keihin, Showa, and Nissin as the ultimate disappearing companies will be implemented.

(3) Integration Schedule (Planned)

Execution of the Basic Contract |

October 30, 2019 (today) |

Commencement date of the Tender Offer |

TBD |

Implementation of Making the Target Companies Wholly-Owned Subsidiaries |

TBD |

Occurrence of effect of the Absorption-type Merger |

TBD |

Section II. Situation After the Integration

1. Overview of the Integrated Company

| Surviving Company in the Absorption-type Merger | |

| (1) Name | Hitachi Automotive Systems, Ltd. (Note) |

| (2) Location | 2520 Takaba, Hitachinaka-shi, Ibaraki (Note) |

| (3) Name and Title of Representative |

Brice Koch, President & CEO (Note) |

| (4) Description of Business Activities |

Development, manufacture, sale, and service of automobile parts, and transportation and industrial machinery, appliances, and systems |

| (5) Capital | Not determined yet |

| (6) Fiscal Year End | March 31 |

| (7) Net Assets | Not determined yet |

| (8) Total Assets | Not determined yet |

(Note) Hitachi and Honda may amend the name and location of the Integrated Company immediately after the occurrence of the Absorption-type Merger, upon discussion with the other parties and consent between Hitachi and Honda by the effective date of the Absorption-type Merger. The representative will be officially determined by the Board of Directors of the Integration Company.

2. Structure of the Board of Directors and Business Execution Structure of the Integrated Company

There will be a total of six directors in the Integrated Company, four of which (among the four, two representative directors) will be designated by Hitachi, and two of which will be designated by Honda. With regard to the business execution structure of the Integrated Company, there will be a number of personnel necessary and appropriate from the viewpoint of maximizing the corporate value of the Integrated Company, based on the business strategy of the Integrated Company. Details will be determined upon discussion among the six companies.

3. Brands of the Integrated Company

The Integrated Company is scheduled to make “Hitachi” or “HITACHI” its corporate brand. The brands of each product that were used in Hitachi Automotive Systems, Keihin, Showa, or Nissin before the occurrence of the Absorption-type Merger will be continued to be used for now, from the viewpoint of maximizing the corporate value of the Integrated Company.

Section III. Comments from Each Party to the Integration

Comment by Mr. Keiji Kojima, Vice President and Executive Officer, Hitachi, Ltd.

“We are very excited to be able to agree on the establishment of the Integrated Company in the automotive and motorcycle systems business. In Hitachi’s Smart life sector to which Hitachi Automotive Systems belongs, Hitachi Automotive Systems is strengthening core businesses such as powertrain systems, chassis, and safety systems in order to create communities that are easy to live in, which helps improve the quality of people’s lives. The establishment of the Integrated Company will accelerate this transformation.”

Comment by Mr. Noriya Kaihara, Managing Officer, Honda Motor Co., Ltd.

“We are very pleased and excited to have established a partnership towards the new era. We are confident that by the synergy created by intercrossing the strengths of the three companies that are active as the core of the Honda Group with that of Hitachi Automotive Systems, technological development will further accelerate. Through this new partnership, we will contribute to the expansion of the joy of transportation of customers around the world and to the development of the personal mobility industry.”

Comment by Dr. Brice Koch, President & CEO, Hitachi Automotive Systems, Ltd.

“At a time when the automotive and motorcycle industry landscape is being redesigned, these business enhancement measures will create a new global Tier 1 supplier with global leadership positions across xEV, ICE, suspensions, brakes, steering, and safety systems. The increased scale and global leadership position of the Integrated Company, as well as complementary footprints and technology portfolios, will allow the company to better respond to customer needs and be in a stronger position to succeed. I am excited to work together with my new colleagues to make this ‘one in a life time’ opportunity a great success for all our stakeholders.”

Comment by Mr. Keiichi Aida, Representative Director and Director President, Keihin Corporation

“We are happy that we are able to participate in the establishment of a new global leading supplier. We have been providing management systems for engines and electric powertrains to contribute to the future of the environmental sector. We are confident that it will be possible to provide more attractive solutions to customers by combining the strengths of the four companies through this integration. With this integration, by becoming a company that can acquire more sympathy and trust, we will provide more joy to all stakeholders.”

Comment by Mr. Nobuyuki Sugiyama, Representative Director and Director President, Showa Corporation

“We are excited and feel responsible for this Integration to be a significant step to complete “a change to a system supplier suggesting integrated control systems with higher added value,” which has been an important issue for our company. We are confident that we will be the leading company that survives in the future “CASE” era by integrating our technology for “driving” and “turning,” which we have accumulated to date, with the advanced technologies of the integrating companies. This challenge to realize chassis controls with higher added value and integrated control systems for autonomous driving in both the motorcycle and automobile sectors and to become the leading supplier in the industry will substantially enhance our contribution to society and customer trust due to technological innovation, and also to the exponential growth of employees.”

Comment by Mr. Yasushi Kawaguchi, President and Representative Director, Nissin Kogyo Co., Ltd.

“We are very happy that we are able to participate in the establishment of a new global supplier. We have been enhancing our aluminum products and brakes technology to respond to the needs for “environment” and “safety” of automobiles and motorcycles. By combining the strengths of the six companies that are participating in this integration and creating synergy, it will be possible to provide top-class solutions to more customers into the future. We are confident that the new company will be able to provide stronger sustainability to all stakeholders and society.”

Section IV. Overview of the Parties to the Integration

| Surviving Company in the Absorption-type Merger | ||||

| (1) Name | Hitachi Automotive Systems, Ltd. | |||

| (2) Location | 2520 Takaba, Hitachinaka-shi, Ibaraki | |||

| (3) Name and Title of Representative |

Brice Koch, President & CEO | |||

| (4) Description of Business Activities |

Development, manufacture, sale, and service of automobile parts, transportation and industrial machinery and appliances, and systems | |||

| (5) Capital | 15,000 million Japanese yen (as of September 30, 2019) | |||

| (6) Date of Establishment |

July 1, 2009 | |||

| (7) Fiscal Year End | March 31 | |||

| (8) Number of Employees | 25,176 employees (as of September 30, 2019) | |||

| (9) Major Clients | Nissan Motor Co., Ltd., SUBARU CORPORATION, Ford Motor Company, General Motors Company, Honda Motor Co., Ltd., Toyota Motor Corporation, etc. | |||

| (10) Major Transaction Banks | N/A | |||

| (11) Major Shareholders and Ownership Percentage (as of September 30, 2019) | Hitachi, Ltd. | 100% |

||

| (12) Management Performance and Financial Condition for the Past Three Years | ||||

Fiscal Term |

March 2017 | March 2018 | March 2019 | |

| Consolidated Sales | 992,284 |

1,001,036 |

971,007 |

|

| Consolidated Operating Income | 56,362 |

49,569 |

38,041 |

|

(Units: 1 million yen, unless otherwise specified.)

| Disappearing Company in the Absorption-type Merger | ||||||

| (1) Name | Keihin Corporation | |||||

| (2) Location | 26-2, Nishishinjuku 1-chome, Shinjuku-ku, Tokyo | |||||

| (3) Name and Title of Representative |

Keiichi Aida, Representative Director, Director President | |||||

| (4) Description of Business Activities |

Manufacture and sale of parts for motorcycles and automobiles | |||||

| (5) Capital | 6,932 million Japanese yen (as of September 30, 2019) | |||||

| (6) Date of Establishment |

December 19, 1956 | |||||

| (7) Number of Issued Shares | 73,985,246 shares (as of September 30, 2019) | |||||

| (8) Fiscal Year End | March 31 | |||||

| (9) Number of Employees | 23,063 employees (consolidated, as of September 30, 2019) | |||||

| (10) Major Clients | Honda Motor Co., Ltd. | |||||

| (11) Major Transaction Banks | MUFG Bank, Ltd. | |||||

| (12) Major Shareholders and Ownership Percentage (as of September 30, 2019) | Honda Motor Co., Ltd. | 41.35% |

||||

| Japan Trustee Services Bank, Ltd. (Trust Account) | 3.66% |

|||||

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 3.33% |

|||||

| MUFG Bank, Ltd. | 2.62% |

|||||

| Japan Trustee Services Bank, Ltd. (Trust Account 9) | 1.88% |

|||||

| Matsui Securities Co., Ltd. | 1.87% |

|||||

| Nomura Trust and Banking Co., Ltd. (Trust Account) | 1.86% |

|||||

| SSBTC CLIENT OMNIBUS ACCOUNT (standing agency: Tokyo Branch, The Hongkong and Shanghai Banking Corporation Limited) |

1.75% |

|||||

| DFA INTL SMALL CAP VALUE PORTFOLIO (standing agency: Tokyo Branch, Citibank, N.A.) |

1.54% |

|||||

| State Street Bank and Trust Company 505103 (standing agency: Settlement & Clearing Services Department, Mizuho Bank, Ltd.) |

1.37% |

|||||

| (13) | Relationship Between Party Companies | |||||

| Capital Relationship | Honda owns 30,581,115 Keihin shares (ownership ratio 41.35%). Showa owns 1,200 Keihin shares (ownership ratio 0.00%). | |||||

| Personnel Relationship |

As of March 31, 2019, 13 employees of Honda have been temporarily assigned to Keihin. | |||||

| Business Relationship | Keihin sells automobile parts to Honda. | |||||

| Status as Related Parties |

Keihin is an equity-method affiliate of Honda and falls under a related party. Keihin does not fall under a related party of Hitachi Automotive Systems, Showa, Nissin, or Hitachi. | |||||

| (14) Consolidated Operating Results and Consolidated Financial Position for the Past Three Fiscal Years | ||||||

Fiscal Years Ended March 31, |

2017 | 2018 | 2019 | |||

| Total Equity | 193,883 |

208,203 |

223,187 |

|||

| Total Assets | 266,851 |

283,711 |

315,189 |

|||

| Equity Per Share Attributable to Owners of the Parent (yen) | 2,304.26 |

2,494.80 |

2,681.96 |

|||

| Sales Revenue | 325,550 |

351,494 |

349,220 |

|||

| Operating Profit | 22,954 |

28,313 |

26,259 |

|||

| Profit for the Year Attributable to Owners of the Parent | 11,084 |

17,824 |

15,706 |

|||

| Basic Earnings Per Share Attributable to Owners of the Parent (yen) | 149.86 |

241.00 |

212.37 |

|||

| Dividends per Share (yen) | 40.00 |

43.00 |

45.00 |

|||

(Units: 1 million yen, unless otherwise specified.)

| Disappearing Company in the Absorption-type Merger | ||||||

| (1) Name | Showa Corporation | |||||

| (2) Location | 1-14-1 Fujiwara-cho, Gyoda-shi, Saitama | |||||

| (3) Name and Title of Representative |

Nobuyuki Sugiyama, Representative Director, Director President | |||||

| (4) Description of Business Activities |

Manufacture and sale of parts for motorcycles and automobiles and parts for boats | |||||

| (5) Capital | 12,698 million Japanese yen (as of September 30, 2019) | |||||

| (6) Date of Establishment |

October 28, 1938 | |||||

| (7) Number of Issued Shares | 76,020,019 shares (as of September 30, 2019) | |||||

| (8) Fiscal Year End | March 31 | |||||

| (9) Number of Employees | 12,615 employees (consolidated, as of March 31, 2019) | |||||

| (10) Major Clients | Honda Motor Co., Ltd, Harley-Davidson, Inc., SUZUKI MOTOR CORPORATION, SUBARU CORPORATION, MITSUBISHI MOTORS CORPORATION, Mazda Motor Corporation, Kawasaki Heavy Industries, Ltd. |

|||||

| (11) Major Transaction Banks | MUFG Bank, Ltd., Saitama Resona Bank, Ltd., Mizuho Bank, Ltd. | |||||

| (12) Major Shareholders and Ownership Percentage (as of March 31, 2019) | Honda Motor Co., Ltd. | 33.50% |

||||

| Japan Trustee Services Bank, Ltd. (Trust Account) | 4.86% |

|||||

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 4.28% |

|||||

| Japan Trustee Services Bank, Ltd. (Trust Account 9) | 3.93% |

|||||

| Showa Shareholding Association | 2.23% |

|||||

| J.P. MORGAN BANK LUXEMBOURG S.A.1300000 (standing agency: Settlement & Clearing Services Department, Mizuho Bank, Ltd.) |

1.94% |

|||||

| GOVERNMENT OF NORWAY (standing agency: Tokyo Branch, Citibank, N.A.) |

1.78% |

|||||

| MUFG Bank, Ltd. | 1.70% |

|||||

| GOLDMAN SACHS INTERNATIONAL (standing agency: Goldman Sachs Japan) | 1.48% |

|||||

| THE BANK OF NEW YORK MELLON 140044 (standing agency: Settlement & Clearing Services Department, Mizuho Bank, Ltd.) |

1.28% |

|||||

| (13) | Relationship Between Party Companies | |||||

| Capital Relationship | Honda owns 25,447,856 Showa shares (ownership ratio 33.50%). Showa owns 1,200 Keihin shares (ownership ratio 0.00%) and 4,500 Nissin shares (ownership ratio 0.01%). | |||||

| Personnel Relationship |

As of March 31, 2019, 3 employees of Honda have been temporarily assigned to Showa. | |||||

| Business Relationship | Showa sells automotive components to Honda. | |||||

| Status as Related Parties |

Showa is an equity-method affiliate of Honda and falls under a related party. | |||||

| (14) Consolidated Operating Results and Consolidated Financial Position for the Past Three Fiscal Years | ||||||

Fiscal Years Ended March 31, |

2017 | 2018 | 2019 | |||

| Total Equity | 97,340 |

109,658 |

126,534 |

|||

| Total Assets | 205,885 |

201,967 |

210,275 |

|||

| Equity Per Share Attributable to Owners of the Parent (yen) | 1,107.77 |

1,264.72 |

1,491.68 |

|||

| Sales Revenue | 259,495 |

291,989 |

286,692 |

|||

| Operating Profit | (3,263) |

25,296 |

30,142 |

|||

| Profit for the Year Attributable to Owners of the Parent | (11,444) |

13,855 |

19,052 |

|||

| Basic Earnings Per Share Attributable to Owners of the Parent (yen) | (150.65) |

182.39 |

250.80 |

|||

| Dividends per Share (yen) | 0.00 |

22.00 |

36.00 |

|||

(Units: 1 million yen, unless otherwise specified.)

| Disappearing Company in the Absorption-type Merger | ||||||

| (1) Name | Nissin Kogyo Co., Ltd. | |||||

| (2) Location | 801, Kazawa, Tomi-shi, Nagano | |||||

| (3) Name and Title of Representative |

Yasushi Kawaguchi, President and Representative Director | |||||

| (4) Description of Business Activities |

Manufacture and sale of brake equipment for motorcycles and automobiles and aluminum products, etc. | |||||

| (5) Capital | 3,694 million Japanese yen (as of September 30, 2019) | |||||

| (6) Date of Establishment |

October 27, 1953 | |||||

| (7) Number of Issued Shares | 65,452,143 shares (as of September 30, 2019) | |||||

| (8) Fiscal Year End | March 31 | |||||

| (9) Number of Employees | 10,325 employees (consolidated, as of March 31, 2019) | |||||

| (10) Major Clients | Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., SUBARU CORPORATION, Harley-Davidson, Inc., Kawasaki Heavy Industries, Ltd., SUZUKI MOTOR CORPORATION, Isuzu Motors Limited, MITSUBISHI MOTORS CORPORATION, Mazda Motor Corporation |

|||||

| (11) Major Transaction Banks | Sumitomo Mitsui Banking Corporation, The Hachijuni Bank, Ltd., MUFG Bank, Ltd., Mizuho Bank, Ltd. | |||||

| (12) Major Shareholders and Ownership Percentage (as of March 31, 2019) | Honda Motor Co., Ltd. | 34.86% |

||||

| Daishin Sangyo Co., Ltd. | 5.22% |

|||||

| Japan Trustee Services Bank, Ltd. (Trust Account) | 3.43% |

|||||

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 3.37% |

|||||

| SSBTC CLIENT OMNIBUS ACCOUNT (standing agency: Custody Services Department, Tokyo Branch, The Hongkong and Shanghai Banking Corporation Limited) |

3.06% |

|||||

| Naoya Miyashita | 3.01% |

|||||

| Japan Trustee Services Bank, Ltd. (Trust Account 9) | 2.15% |

|||||

| NORTHERN TRUST CO. (AVFC) RE HCROO (standing agency: Custody Services Department, Tokyo Branch, The Hongkong and Shanghai Banking Corporation Limited) |

1.45% |

|||||

| DFA INTL SMALL CAP VALUE PORTFOLIO (standing agency: Tokyo Branch, Citibank, N.A.) |

1.11% |

|||||

| Japan Trustee Services Bank, Ltd. (Trust Account 5) | 1.11% |

|||||

| (13) | Relationship Between Party Companies | |||||

| Capital Relationship | Honda owns 22,682,205 Nissin shares (ownership ratio 34.86%). Showa owns 4,500 Nissin shares (ownership ratio 0.01%). | |||||

| Personnel Relationship |

N/A | |||||

| Business Relationship | Nissin sells automobile parts to Honda and Hitachi Automotive Systems. | |||||

| Status as Related Parties |

Nissin is an equity-method affiliate of Honda and falls under a related party. Nissin does not fall under a related party of Hitachi Automotive Systems, Keihin, Showa, or Hitachi. | |||||

| (14) Consolidated Operating Results and Consolidated Financial Position for the Past Three Fiscal Years | ||||||

Fiscal Years Ended March 31, |

2017 | 2018 | 2019 | |||

| Total Equity | 172,770 |

162,445 |

167,414 |

|||

| Total Assets | 216,005 |

206,423 |

205,467 |

|||

| Equity Per Share Attributable to Owners of the Parent (yen) | 2,280.51 |

2,103.37 |

2,141.67 |

|||

| Sales Amount | 166,889 |

188,221 |

189,693 |

|||

| Operating Profit | 12,278 |

13,162 |

16,301 |

|||

| Profit for the Year Attributable to Owners of the Parent | 5,385 |

(8,717) |

7,344 |

|||

| Basic Earnings Per Share Attributable to Owners of the Parent (yen) | 82.77 |

(133.97) |

112.88 |

|||

| Dividends per Share (yen) | 45.00 |

45.00 |

45.00 |

|||

(Units: 1 million yen, unless otherwise specified.)

Section V. Future Aspects

The effect on business performance is currently under investigation. If it hereafter becomes necessary to revise the business forecast, or any matter that is required to be disclosed to the public occurs, we will promptly disclose such case to the public.