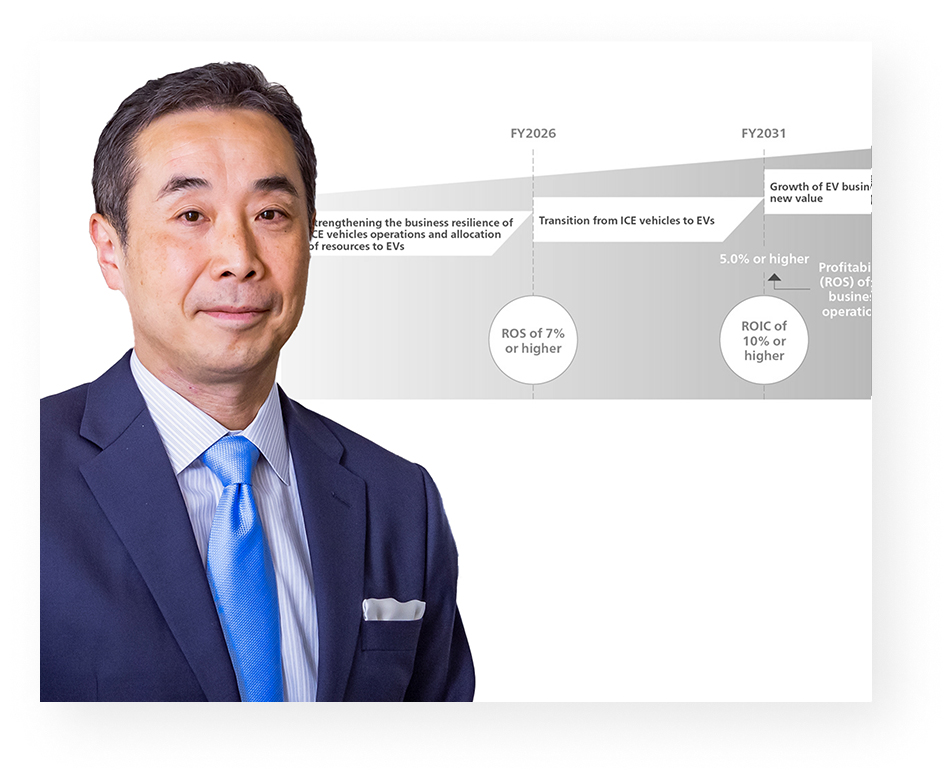

Financial Strategy

We aim to realize enhanced corporate value by implementing flexible resource allocation based on the cash generation capabilities built through strengthening our business structure.

Director, Managing Executive Officer

Chief Financial Officer

Chief Officer,

Corporate Administration Operations

Eiji Fujimura

Progress in Efforts to Enhance Corporate Value

To enhance corporate value, we recognize the need to utilize both financial and non-financial capital to achieve sustainable cash flow growth and improve capital efficiency. To realize this, it is crucial to focus on: (1) strategic resource allocation aligned with the business transformation phase, (2) strengthening management with an awareness of capital costs and responding to environmental changes, and (3) improving management quality and transparency through proactive dialogue. I will explain the progress of these initiatives in the short-term and the financial strategy for the medium to long-term.

Short-Term Progress

For FYE Mar. 31, 2024, we achieved record profits and created 3 trillion yen in Cash Flows from operating activities (CFO) after R&D adjustment

For FYE Mar. 31, 2024, Honda achieved record high profits with operating income of 1,381.9 billion yen and net income of 1,107.1 billion yen. This performance reflects a significant increase, with operating income up 601.2 billion yen and net income up 455.7 billion yen from FYE Mar. 31, 2023. The increase in sales volume, driven by robust demand for hybrid (HEV) models in North America and motorcycles in India and Brazil, contributed to this growth. The cash flows from operating activities (CFO) after R&D adjustment, representing funds for future investments, reached 3 trillion yen, marking an increase of approximately 1 trillion yen from FYE Mar. 31, 2023. This demonstrates that Honda has successfully secured balanced profits across various business operations and established a foundation for future growth.

Forecast for the Fiscal Year Ending March 31, 2025: Achieving a Company-Wide ROS Target of 7% One Year ahead of Schedule

For the Fiscal Year Ending March 31, 2025, Honda plans to achieve an operating income of 1,420.0 billion yen, aiming to meet the revenue target of 7% ROS one year ahead of schedule. Consequently, investments in capital expenditures and R&D expenses to fund future growth will be significantly increased compared to FYE Mar. 31, 2023 to accelerate transformation efforts. Regarding shareholder returns, Honda will raise the dividend for FYE Mar. 31, 2024 to 68 yen, the same level as FYE Mar. 31, 2023, and has resolved to undertake the largest-ever share repurchase of 300 billion yen. Honda will leverage its unique cash generation capabilities from its diverse businesses and mobility portfolio to execute strategic resource allocation.

On the other hand, regarding the stock market’s evaluation of Honda for FYE Mar. 31, 2024, although the stock price has increased by approximately 60% over the past year, showing a certain level of recovery, it remains below a PBR of 1. Management takes this stock market evaluation seriously. We attribute the factors behind Honda’s PBR remaining below 1 to “a decline in capital efficiency due to the accumulation of capital over time,” “the profitability of the Automobile business,” and “the inability to dispel concerns about the uncertain future of electrification.” While demonstrating improvements with results in the short-term, we aim for the early achievement of a PBR above 1 by further strengthening our efforts toward the three key missions explained earlier, both in the medium and long-term.

Topic: Cash Flows from Operating Activities (CFO) after R&D Adjustment

While managing the balance between resource allocation for future growth and shareholder returns, we recognize the importance of generating sustainable cash flow even during periods of business transformation. To this end, we have begun disclosing the “Cash flows from operating activities (CFO) after R&D adjustment,” *1 which serves as an indicator of this objective.

- *1Cash flows from operating activities (CFO) after R&D adjustment: CFO excluding R&D expenses (CFO of non-financial services businesses + R&D expenditures – amount transferred to development assets)

Medium and Long-Term Initiatives

Financial Targets

Honda has segmented its management plan into phases of transformation, setting specific financial targets for each. For the Fiscal Year Ending March 31, 2026, the goal is to strengthen the business structure towards transformation, aiming for an ROS of 7% or higher. By the Fiscal Year Ending March 31, 2031, in anticipation of the business transition from ICE products to EVs, the company has set targets of achieving a company-wide ROIC*1 of 10% or higher and a EV ROS of 5% or higher. The company-wide ROIC specifically consists of the ROIC from business domains related to the manufacturing and sale of motorcycles, automobiles, and power products, as well as the ROE from the financial services business, with a target of 10% or higher for each.

- *1ROIC: (Profit for the year attributable to owners of the parent + Interest expenses [excluding financial businesses]) / Deployed capital*2

- *2Deployed capital: Equity attributable to owners of the parent + Interest-bearing liabilities (excluding those from the financial business sector). Deployed capital is calculated using the average of the beginning and end of the period.

Goals for Each Phase of Business Transformation

Topic | KPI for Financial Services Business: ROE

As its business structure is based on financial assets and funding, financial services operations utilizes Return on Equity (ROE), which takes into account financial leverage, as a measure of capital efficiency.

Capital Allocation for Future Growth

I will explain the capital allocation for future growth (excluding the financial services business) in phases aligned with our business transformation. This will be discussed over two five-year periods: from FYE Mar. 31, 2022 to the Fiscal Year Ending March 31, 2026, and from the Fiscal Year Ending March 31, 2027 to the Fiscal Year Ending March 31, 2031.

Cash Generation

FYE Mar. 31, 2022 to the Fiscal Year Ending March 31, 2026

Over the period up to the Fiscal Year Ending March 31, 2026, we anticipate generating 12 trillion yen in cash flows from operating activities (CFO) after R&D adjustment, as previously mentioned, our annual cash generation capability has improved to a scale of 3 trillion yen. I believe we are generally on track to achieve our cash generation targets by the Fiscal Year Ending March 31, 2026. Going forward, I will continue to focus on capital efficiency and revise our resource allocation plans to drive further improvements.

The Fiscal Year Ending March 31, 2027 to the Fiscal Year Ending March 31, 2031

In the five years from the Fiscal Year Ending March 31, 2027, Honda aims to generate more cash than in the previous five years, driven by continuous earnings from Internal Combustion Engine (ICE) areas and growth in EV. For the ICE area, the expansion of the motorcycle business and further improvement of automobile Hybrid Electric Vehicle (HEV) models will be key drivers. HEV models will see enhancements in competitiveness and profitability through platform updates and further performance improvements of HEV systems. Regarding EVs, Honda will increase cash generation by reducing costs through the establishment of comprehensive value chain centered on core components like batteries, and by lowering production costs through the develoment of highly-efficient production systems at dedicated EV factories.

While strengthening initiatives across these business areas, we will also maintain a flexible approach in response to changes in the business environment. This will enable us to steadily secure the necessary resources for future growth, even during the transition period from ICE to EV.

Investments for Future Growth

To realize our electrification strategy, a key measure to achieving carbon neutrality by 2050, Honda deems it essential to strategically allocate resources at the appropriate timing. Over the ten years leading up to the Fiscal Year Ending March 31, 2031, Honda plans to invest 10 trillion yen in electrification and software areas.

Over the five years up to the Fiscal Year Ending March 31, 2026, Honda plans to invest 3.5 trillion yen out of the total 10 trillion yen. This investment will increase the proportion of R&D expenditures and accelerate preparations for competitive next-generation EVs.

In the five years from the Fiscal Year Ending March 31, 2027 onwards, Honda will expand its investment in electrification and software areas to 6.5 trillion yen. Currently, R&D expenditures are high due to parallel development of ICE and EV, however, these expenditures are expected to gradually decrease as the shift to EV progresses. Meanwhile, Honda will increase investments and funding to build a vertically integrated value chain, including EV-exclusive factories. Decisions on resource allocation will be made by assessing the pace/degree of EV market penetration and by determining appropriate investment timing while maintaining flexibility, as explained earlier.

Shareholder Returns

Returning benefits to shareholders is positioned as one of the most important management priorities.

Honda plans to distribute over 1.3 trillion yen in dividends from FYE Mar. 31, 2022 to the Fiscal Year Ending March 31, 2026 and over 1.6 trillion yen from the Fiscal Year Ending March 31, 2027 to the Fiscal Year Ending March 31, 2031. This demonstrates management’s commitment to maintaining at least the current dividend levels while investing in transformation and ensuring stable and continuous returns.

Regarding share repurchases, including the 300.0 billion yen announced on May 10, 2024, Honda has resolved to repurchase a total of 790.0 billion yen in shares since FYE Mar. 31, 2022. Moving forward, share repurchases will be conducted as needed to improve capital efficiency and implement flexible capital policies.

Heightening Management Consciousness of Capital Costs and Financial Resilience during Periods of Transformation

To enhance corporate value by flexibly and appropriately responding to environmental changes, we aim to infuse management with a heightened sensitivity of capital costs, maintain multiple options based on timeframes, and manage risks through flexible resource allocation.

For FYE March 31, 2024, the Return on Invested Capital (ROIC) improved to 9.1%, an increase of 3.2% from FYE March 31, 2023, due to efforts in enhancing business constitution and strengthening shareholder returns. During the upcoming transformation period, investments for the future will proceed, but investment decisions will be made based on capital costs using Net Present Value (NPV). As a crucial management goal, we aim to maintain a company-wide ROIC that exceeds the cost of capital.

Company-wide ROIC Trends

Reduction of Policy Shareholdings

Honda is committed to reducing policy-held shares promptly from the perspective of enhancing corporate governance. In July 2024, in a first-of-its-kind move for a Japanese company, Honda executed a plan to simultaneously eliminate all company shares held under such policies by insurers and banks through a public offering, aimed at broadening and diversifying the shareholder base to further enhance discipline in corporate management. Going forward, Honda will continue to lead the way in moving away from the mutual holding of policy-held shares, collaborating with a wide range of investors who can support our business activities in the medium to long-term, to build a strong brand and business foundation, and achieve further enhancement of corporate value.

Financial Resilience during Transformation

During the full-scale transition to EVs, it is necessary to implement large-scale resource investment aimed at transformation. While the long-term perspective remains unchanged with the steady progression of the EV shift—having already announced investments for building a vertically integrated EV value chain in Canada—the business environment continues to be highly uncertain due to economic trends, changes in environmental regulations, and technological innovations. In order to address the unique challenges Honda will face, we believe it is crucial to minimize financial losses through flexible responses to risks.

Honda’s technological prowess has spawned multiple businesses and various products and built a business constitution capable of making flexible and speedy choices even under uncertain business conditions. By accurately assessing changes in the business environment, such as in scenarios where EV demand slows, Honda will enhance cash generation through HEV models, control investment timing in the electrification sector and leverage scale benefits through alliances. By maintaining multiple options and implementing flexible resource allocation, Honda aims to effectively manage risks.

Proactive Dialogue with Stakeholders

To ensure that our management direction is correctly understood and appreciated by stakeholders, including shareholders and investors, our management team will proactively pursue and engage in increased dialogue through events and individual interviews.

During FYE March 31, 2024, we conducted seven IR tours across Japan, U.S., Europe, and Asia, holding over 1,000 individual meetings. In addition to increased participation from our President, Vice President, and CFO, from FYE March 31, 2024, our technical managers team also joined the dialogues to more clearly communicate what differentiates Honda in the electrification era. Through these dialogues, our management and technical leaders directly conveyed our growth strategy. Coupled with an enhanced understanding of what the capital markets expect from Honda, we aim to leverage this insight in our management and business strategies. By doing so, we strive to achieve a PBR of more than 1 at an early stage and continuously enhance our corporate value, ensuring that Honda remains a company that stakeholders continue to value and expect great things from.

Track Record of Dialogue with Securities Analysts and Institutional Investors (President, Vice President, CFO, and Technical Managers in Each Area)

(Not including stock offering roadshows)

(Other events)

| Dialogues | FYE Mar. 31, 2022 (Apr-Mar) |

FYE Mar. 31, 2023 (Apr-Mar) |

FYE Mar. 31, 2024 (Apr-Mar) |

Fiscal Year Ending March 31, 2025 (Apr-Jul) |

|---|---|---|---|---|

| Financial results briefing for securities analysts and institutional investors |

4 | 4 | 4 | 1 |

| IR tours (Japan, U.S., Europe, Asia) | (Online) | 2 | 7 | 3 |

| Conferences hosted by securities firms | 7 | 6 | 14 | 6 |

| Regional and office visits | 4 | 5 | 10 | 3 |

| Briefings for individual investors (Japanese only) | ‐ | 1 | 4 | 1 |

| ESG dialogue | 25 | 64 | 40 | 30 |

| (Reference) Stock offering roadshow*1 | ‐ | ‐ | ‐ | 101 |

- *1IR dialogue with domestic and foreign institutional investors related to stock offering