POINTWhat you can learn from this article

- Honda has developed the Indian motorcycle market by adopting various products and sales strategies tailored to the region’s characteristics

- Following the dissolution of its partnership with a local conglomerate in 2010, Honda experienced a significant decline in market share, but through persistent sales and service efforts, has continued to grow

- As the Indian economy grew, demand for mid-to-large motorcycles rose, offering not only practicality but also recreational value and experiential benefits

In May 2025, Honda’s global motorcycle production reached a cumulative total of 500 million units. To commemorate this milestone, a ceremony was held on May 22 at Honda Motorcycle & Scooter India (HMSI), Honda’s production and sales company based in India, the world’s largest motorcycle market.

2025 also marks the 25th anniversary of HMSI’s establishment, and the company has surpassed 70 million units in cumulative motorcycle production.

Honda first entered the Indian motorcycle market in the 1980s. This issue of Honda Stories looks back on Honda’s history of expanding into the Indian market, through its expatriates who were involved in sales and service locally.

Five regions with completely different Indian cultures

――What is India like?

India is a vast country with a land area of approximately 3.287 million square kilometers, about eight times the size of Japan, and a population of over 1.3 billion. It is home to more than eight religions and 22 languages. In terms of demographics, over half the population is under the age of 30. Each region has distinct ethnic groups, cuisines, and business customs, and its diversity, according to some expatriates, is remarkably contained within one united country.

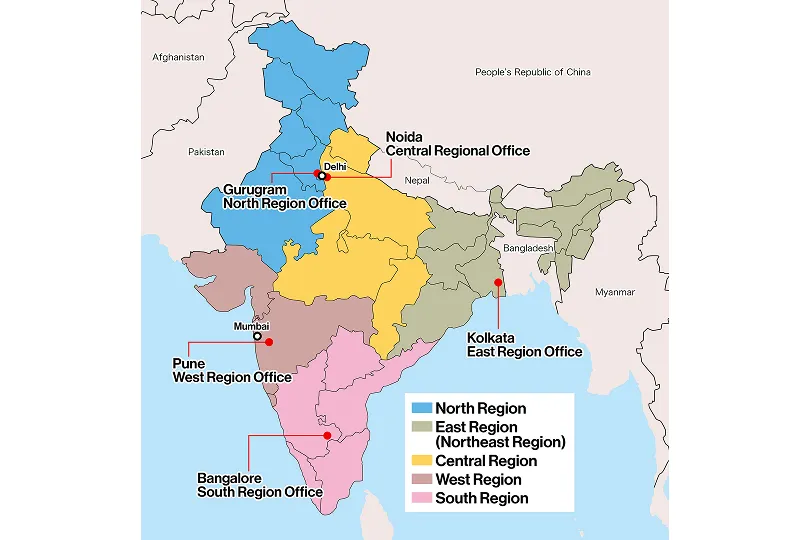

The country is broadly divided into five regions: East India (including Northeast India), West India, South India, North India, and Central India located inland. Each region has its own distinct characteristics. For example, the southwest region has many IT companies and is open to new values, with scooters selling well. In contrast, the northeastern and central regions are traditional areas where ancient Indian cultural customs remain strong, and the primary mode of transportation for daily life is the 100–125cc small (non-scooter) motorcycle (simply referred to as “motorcycles”).

HMSI’s representative models, the Activa 110 (left), a step-through scooter, and the Shine 100 DX (right), a conventional motorcycle that plays a crucial role in rural development (which will be mentioned later)

HMSI’s representative models, the Activa 110 (left), a step-through scooter, and the Shine 100 DX (right), a conventional motorcycle that plays a crucial role in rural development (which will be mentioned later)

Honda has established offices in each of these five regions and has dispatched expats to work closely with local associates* to develop and implement sales strategies tailored to the characteristics of each region.

*At Honda, every employee working around the world is referred to as an associate (colleague)

――What are the characteristics of the Indian market?

From mid-October to mid-November, the Hindu festival of lights, Diwali, is held in India over five days. The Diwali period is the busiest shopping season of the year. The first day of Diwali is called “Dhanteras,” and it is believed to bring good luck to bring home gold, silver, and iron. On this day, consumer demand explodes, ranging from everyday kitchenware to large purchases like motorcycles and cars. On Dhanteras, motorcycle sales can reach nearly 10 times the typical daily volume. This trend is observed across most regions of India, and sales strategies in the Indian market are centered around Diwali.

To take advantage of this busy period, goods need to be stocked in advance and warehouse space for storage needs to be secured. In some cases, temporary motorcycle warehouses may need to be rented, such as converting cattle sheds, and logistics and pre-delivery preparations for motorcycles require additional time. Furthermore, there is a surge in demand for after-sales service one month later due to the first round of inspection, so maintenance systems must be prepared in advance.

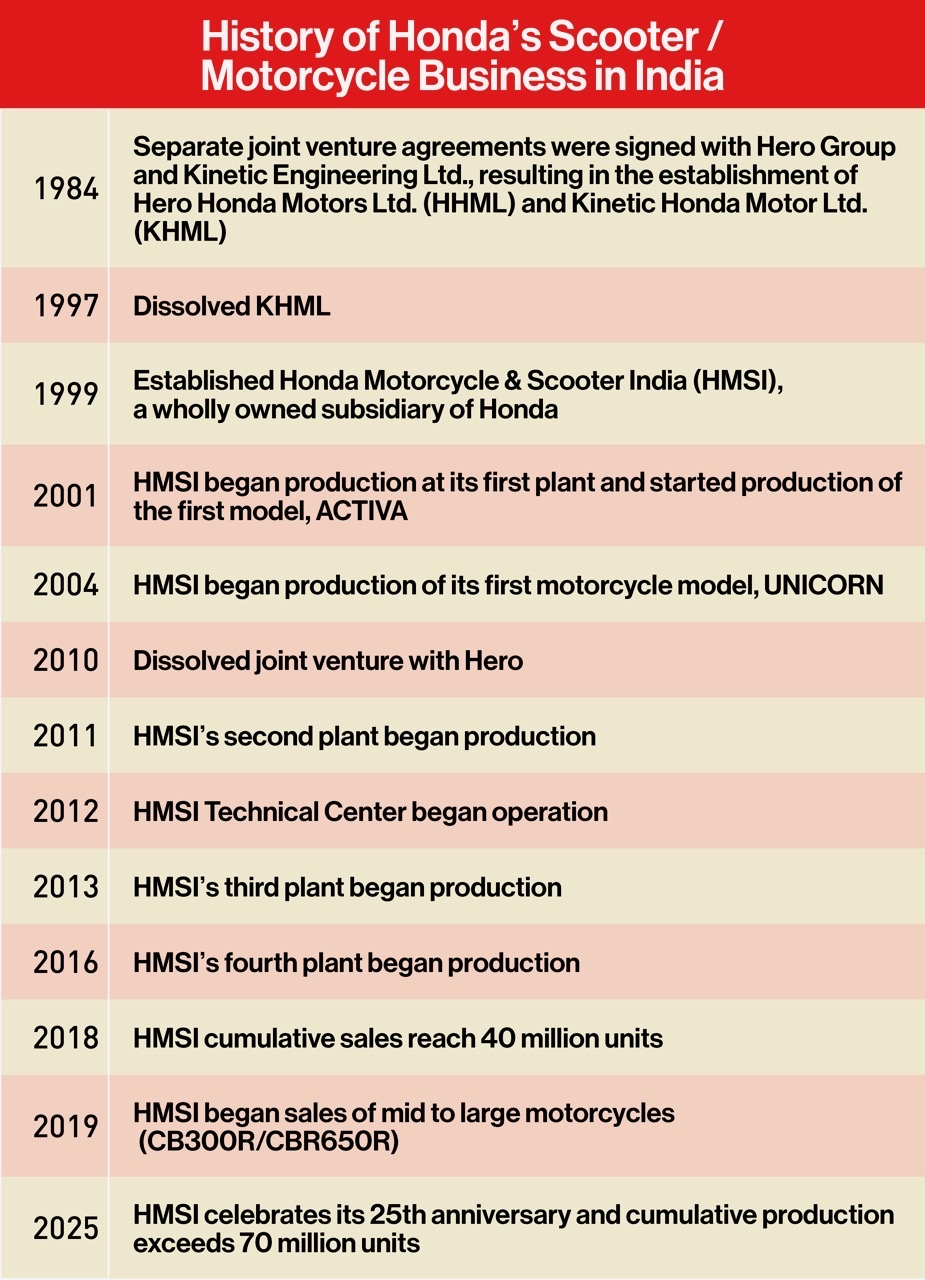

On the eve of expanding into India

Honda's efforts to expand into the Indian motorcycle market date back to the 1980s. At the time, India was under a planned economy system focusing on the nationalization of major industries, and foreign capital including Honda could not establish local companies without forming a joint venture with local capital. Honda entered into joint venture agreements for motorcycle production with the Hero Group, a major conglomerate with a wide range of businesses in India, and Kinetic Engineering Ltd., which held a high market share in the Indian motorcycle market at the time with its mopeds. In 1984, Hero Honda Motors Ltd. (HHML), commonly known as Hero Honda, and Kinetic Honda Motor Ltd. (KHML) were established.

Hero Honda Motors Ltd. (HHML) was established through a partnership with the Hero Group, which owned Hero Cycle, the world’s largest bicycle manufacturer

Hero Honda Motors Ltd. (HHML) was established through a partnership with the Hero Group, which owned Hero Cycle, the world’s largest bicycle manufacturer

KHML was dissolved in 1997, and in 1999, with regulation changes allowing 100% foreign ownership of corporations in India, Honda Motorcycle & Scooter India (HMSI), a wholly owned subsidiary of Honda responsible for motorcycle manufacturing and sales in India was established. HHML focused on motorcycles in the 100–150cc segment, which accounted for the majority of the market, while HMSI targeted scooters popular in urban areas, forming a clear differentiation. During this period, HHML achieved the world’s highest production and sales volume, demonstrating remarkable growth.

HMSI’s first model, the ACTIVA, achieved cumulative production of 100,000 units within 15 months since starting production in 2001, and subsequently secured over 50% market share in India’s mid-size scooter market.

HMSI had taken a solid first step as a new company.

HMSI’s first model, the ACTIVA

HMSI’s first model, the ACTIVA

In 2004, five years after its founding, HMSI unveiled its first motorcycle, the UNICORN. Having previously focused exclusively on scooters, the company expanded its lineup to include motorcycles, growing further and achieving production of 1 million units by 2005.

In 2010, HMSI and HHML engaged in extensive discussions to explore the optimal framework for mutual growth in the rapidly expanding Indian motorcycle market, where customer needs were becoming increasingly diverse. As a result, Honda sold all its shares in HHML to Hero, dissolving the joint venture.

With this dissolution, Honda needed to focus on expanding its market share as HMSI.

In expanding into the Indian motorcycle market, increasing sales of motorcycles, which account for the majority of the market, was essential, and this required extraordinary efforts on the ground.

HMSI, Honda’s 100% owned local subsidiary in India

HMSI, Honda’s 100% owned local subsidiary in India

On the frontlines of Indian Market Expansion

――Understanding the market: Top 35 strategy using the “phone book”

Following the agreement to dissolve the joint venture with Hero Group, the market share that had previously been over 70% combined between HHML and HMSI dropped to around 10% for HMSI alone. Reclaiming the top spot within three years became HMSI’s primary mission.

First, staff with extensive on-site experience were selected and dispatched as expat representatives to offices in each region to implement strategies tailored to regional characteristics. Additionally, large-scale surveys were conducted with the assistance of local associates, resulting in the selection of 35 key regions (Top 35) out of approximately 6,000 administrative districts nationwide.

The materials compiled from various marketing data for each region and zones (district) linked to the region became thick books known as “phone books”. Several versions of these phone books were then created for each region and zone. Based on these, strategies and execution plans were gradually implemented by associates and dealers, leading to sales results in the Top 35 regions and other areas.

“Taking over from experienced expatriates was no easy task. I spent my days running around, striving to instill into associates and dealers both the strategies and execution based on the phone book,” says Yoshitaka Nakamura (center), who served as a sales expatriate at the East Region Office in India from 2014 to 2017.

“Taking over from experienced expatriates was no easy task. I spent my days running around, striving to instill into associates and dealers both the strategies and execution based on the phone book,” says Yoshitaka Nakamura (center), who served as a sales expatriate at the East Region Office in India from 2014 to 2017.

――The “Honda is Honda” strategy

After the joint venture with Hero Group was dissolved, scooter sales remained strong in urban areas. However, in the central and northeast regions, where motorcycle demand was high, the perception that Honda and Hero were synonymous remained deeply rooted within the market, and many consumers continued to confuse the brands.

In response, Honda launched its “Honda is Honda” strategy to re-establish the brand’s market presence and regain consumer trust. Honda implemented various initiatives to enhance brand recognition, including installing Honda signage at dealerships, screening iconic videos featuring F1 cars and large motorcycles to convey the Honda brand worldview, wrapping buses and trains, and producing commercials featuring popular Hindi (Bollywood) actor Akshay Kumar, whose films had achieved high box office success in Mumbai and other areas. Through these efforts, Honda’s presence in the Indian market steadily grew, and the recognition that “Honda is Honda Motor’s global brand” became widely established.

――Increasing dealerships

At the time, Honda had few dealerships in India, and it was imperative to increase its presence nationwide to ensure that customers could purchase motorcycles wherever they wanted. Honda’s motorcycle business, which sold 1 million units annually across India, was attractive to dealership owners, and the number of dealerships increased, beyond those directly contracted with Honda, to sub-dealers without direct contracts and secondary dealers that only handled parts sales and services.

Honda actively opened stores in areas where there were no Honda dealerships. Honda continued its efforts to open one new dealership per day, expanding the number from approximately 800 in 2010 to more than 5,000 in 2017. The goal was to make Honda dealerships the place where customers would purchase Honda motorcycles, return for maintenance and parts replacement, and replace their old motorcycles. Honda focused on efforts to expand profits by successfully repeating this cycle.

Among its efforts to increase the number of dealerships, the biggest challenge was expanding into rural areas.

――“Honda Rural Strategy”: Developing rural areas

Staff stationed in India who had been involved in Honda’s various initiatives agree that the “Rural Strategy,” an aggressive expansion into the most conservative rural areas of India, was the most grueling of all. In the early to mid-2010s, scooters accounted for approximately 25% of motorcycle sales in India, with the remaining 75% being motorcycles, which sold well in rural areas. At the time, Honda was focusing its store expansion in urban areas, leaving rural areas with few dealerships. To gain market share, Honda decided to rapidly expand into rural areas with high demand for motorcycles.

In rural areas with underdeveloped public transportation, the only way to travel was by car, and these areas were too far to visit in a single day. With poorly maintained roads limiting speeds to only 30–40 km/h, the journey was a five-day drive through rough terrain. At accommodations along the way, it was common to have no hot water in the shower and to sleep on hard beds. Even so, spending the night in the car was not unusual—in situations where simply having a place to lie down was considered a luxury.

A typical rural drive

A typical rural drive

“Not only did local associates take turns by area to accompany us, but we also developed a bond akin to comrades-in-arms with the driver over the week-long trek,” says Hiroki Yoshitama (right), who was stationed at the north and west region offices as a service representative from 2014 to 2018.

“Not only did local associates take turns by area to accompany us, but we also developed a bond akin to comrades-in-arms with the driver over the week-long trek,” says Hiroki Yoshitama (right), who was stationed at the north and west region offices as a service representative from 2014 to 2018.

Upon arrival, Honda staff would inquire about the village chief known as the “Sarpanch”, locate them, schedule an appointment, provide a thorough explanation of Honda, and after gaining their understanding, begin the tedious process of negotiating permission to set up a dealership. In village societies, people tend to choose products that everyone else is buying, rather than new products, especially in low-income areas where mistakes in purchasing are not tolerated. They therefore place a strong emphasis on the opinions of trusted individuals, or word-of-mouth. As entire village communities could be swayed by the opinions of their influential figures, Honda staff persistently built trust through village meetings and expanded word-of-mouth recommendations from there.

“The main source of information in rural areas is word-of-mouth. To break into the stronghold of competing motorcycle brands, we repeatedly visited rural areas,” says Takashi Watarai (left), who was stationed in the north region of India from 2010 to 2015.

“The main source of information in rural areas is word-of-mouth. To break into the stronghold of competing motorcycle brands, we repeatedly visited rural areas,” says Takashi Watarai (left), who was stationed in the north region of India from 2010 to 2015.

In the northwestern Indian state of Rajasthan, there was once an area known as an “untouched rural region.” At the time, security was so poor that taking photos was not allowed, and the market was dominated by a single competing motorcycle brand.

In the northwestern Indian state of Rajasthan, there was once an area known as an “untouched rural region.” At the time, security was so poor that taking photos was not allowed, and the market was dominated by a single competing motorcycle brand.

“Sales and service always go hand in hand. Especially in rural areas, we placed great importance on the idea that dealerships are meaningless if they cannot provide maintenance, and we put a lot of effort into expanding our service network,” says Koji Takahashi (center), who was stationed at HMSI headquarters from 2015 to 2020. During his assignment, he oversaw customer service operations, visited regions, and provided on-site advice. He also worked with dealership owners to implement initiatives aimed at improving after-sales operations in India.

“Sales and service always go hand in hand. Especially in rural areas, we placed great importance on the idea that dealerships are meaningless if they cannot provide maintenance, and we put a lot of effort into expanding our service network,” says Koji Takahashi (center), who was stationed at HMSI headquarters from 2015 to 2020. During his assignment, he oversaw customer service operations, visited regions, and provided on-site advice. He also worked with dealership owners to implement initiatives aimed at improving after-sales operations in India.

Even after sales staff made steady efforts to open new venues, there were cases where the dealership had to close due to insufficient demand.

To learn from these experiences, in regions where demand was not sufficient to justify establishing a physical dealership, Honda made efforts to directly introduce products and services to customers. This included using a caravan truck provided by dealers to travel to rural areas and hold temporary workshops in village squares to promote products. In regions where agriculture is the primary industry, Honda staff participated in tractor exhibitions and continued steady efforts to enhance Honda brand awareness. Through trial and error, sales gradually expanded.

Caravan truck promotion (left) and workshop (right) in rural areas

Caravan truck promotion (left) and workshop (right) in rural areas

As a result, Honda’s motorcycle market share increased by approximately 15% over the four-year period from 2011 to 2015. The steady efforts in sales and service had paid off.

Evolving India, evolving bikes, and responding to evolving demands

――Promoting digitalization amid the COVID-19 pandemic

COVID-19, which spread globally from early 2020, claimed many lives, including those of HMSI’s associates. Amid city lockdowns, Honda made every effort to create a safe environment for both customers and employees, including mandatory vaccination for sales associates and the application of disinfectant at dealership locations. Customer satisfaction, for which Honda had been ranked number one every year since 1994, remained at the top. To continue being a company that customers support, Honda spared no effort during the pandemic.

“Amid the chaos, we couldn’t even hold proper farewell parties,” said Masashi Yahata (second from right), HMSI headquarters service representative from 2019–2024. The COVID-19 pandemic in India was a significant challenge both professionally and personally.

“Amid the chaos, we couldn’t even hold proper farewell parties,” said Masashi Yahata (second from right), HMSI headquarters service representative from 2019–2024. The COVID-19 pandemic in India was a significant challenge both professionally and personally.

Despite the pandemic, the motto for expanding the Indian market was to always take on new challenges, and to think while acting. One example was improving the dealer management system to enable tablet-based access to records and data. Honda also launched the Smart Workshop initiative, which allows customers to view the progress of maintenance work on their smartphones, such as “Under maintenance” or “Car wash in progress.”

――Transforming the joy of riding into an experience: Creating the BigWing world together with customers

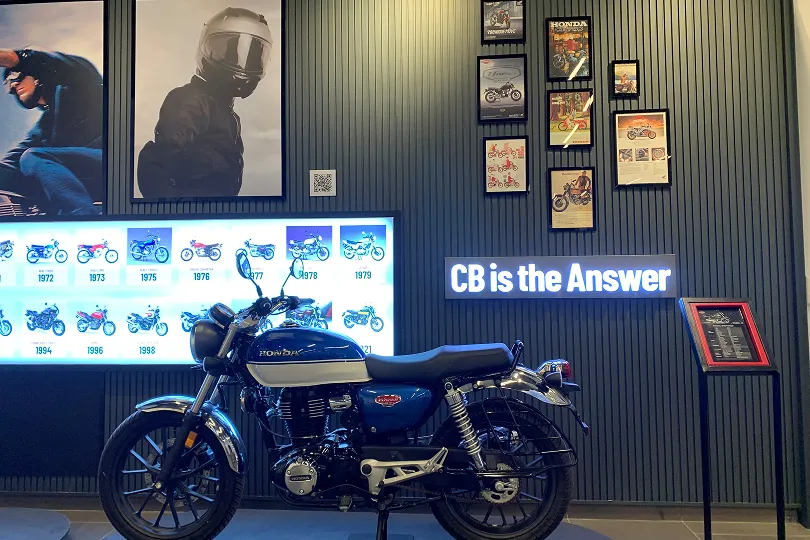

Around 2020, travel restrictions and a decrease in overseas travel due to COVID-19 led to an increase in people enjoying motorcycle touring as an alternative. Additionally, with the economic growth of the Indian market, there was a clear shift from motorcycles as a means of daily transportation to motorcycles as a hobby that expressed individuality. In response, Honda launched the BigWing brand in 2020. This was introduced alongside its existing Red Wing dealerships, which feature the iconic red wing symbol and specialize in small 100cc to 125cc scooters and motorcycles. The BigWing brand was created to meet the growing demand for mid-to-large-sized motorcycles that emphasize “fun” and “hobby,” while also proposing a new lifestyle. With the brand concept of “Excite the World,” Honda began expanding its dealership network. Starting with the CB350 (sold in Japan as the GB350), Honda introduced a mid-sized model powered by a 350cc engine as the core product and gradually added larger models to the lineup.

At a BigWing dealership

At a BigWing dealership

In response to competitors in the mid-to-large motorcycle segment, Honda actively promoted its global brand identity and competitive advantages, leveraging its strengths in global racing activities, advanced technology, and quality.

Additionally, for customers who purchased the CB350 series at BigWing dealerships, Honda organized events where they could participate in group rides in their respective regions, focusing not only on product appeal but also on creating unique experiences that go beyond the product. The “value creation” approach prioritized “experiences and meaning” over “objects.”

Riding event with BigWing customers organized at HMSI headquarters

Riding event with BigWing customers organized at HMSI headquarters

These marketing and sales activities aligned with customer needs had borne fruit, with BigWing dealerships expanding to 150 stores across major cities within approximately three years of their launch in 2020.

“Even after I left India, seeing the number of Honda fans grow day by day in the country is truly heartwarming. During my time there, I was never scolded for making mistakes; instead, there was a culture that encouraged taking on challenges without hesitation, which accelerated my personal growth. I am deeply grateful to the senior colleagues at HMSI who provided me with both warm and rigorous guidance,” said Ryusuke Imamura (right), who served as a sales representative in the BigWing department in India from 2021 to 2024. During this time, he was involved in BigWing sales strategy and product planning.

“Even after I left India, seeing the number of Honda fans grow day by day in the country is truly heartwarming. During my time there, I was never scolded for making mistakes; instead, there was a culture that encouraged taking on challenges without hesitation, which accelerated my personal growth. I am deeply grateful to the senior colleagues at HMSI who provided me with both warm and rigorous guidance,” said Ryusuke Imamura (right), who served as a sales representative in the BigWing department in India from 2021 to 2024. During this time, he was involved in BigWing sales strategy and product planning.

――Don’t stop, keep on going

“It was all about trial and error. Don’t stop, keep moving, and challenge yourself. Always think about what you can do to make the people in India happy while you’re working,” was the motto at the time, according to staff who were stationed in India.

Sales representatives paid attention to service maintenance, while service representatives approached customers with a sales mindset to drive repeat purchases. Despite the small team of expatriates and local associates, they collaborated across departmental boundaries.

There were numerous challenges, including strengthening service systems and maintaining quality in response to increased sales, addressing the market needs for both every day and recreational motorcycles, and further strengthening the Honda brand in rural areas. Additionally, in India, where low female employment rates are a social issue, HMSI promoted the creation of a workplace where women can work comfortably, including its production sites. With the goal of increasing the proportion of women among all employees to 30% by 2030, HMSI is steadily advancing initiatives toward achieving this target across the entire organization.

Honda aims to provide Indian customers with “the joy of free and enjoyable mobility” through its products, as well as the “joy of expanding their life’s potential”. Honda continues to take on challenges to remain one that customers in India want to exist.

We are No.1!

We are No.1!