Report on Inappropriate Trading Activities by a Honda Subsidiary and Measures to Prevent a Recurrence

February 15, 2011, Japan

On January 24, 2011, Honda Motor Co., Ltd. (the "Company") announced the discovery of inappropriate trading activity by the Seafood Section of the Foodstuff Division of Honda Trading Corporation ("HT") and the resulting financial impact.

Today, the Company received a report by its investigation committee on the facts, causes, responsible persons and existence of any similar incidents at HT, and the Company wishes to announce such results together with the measures it is taking to prevent a recurrence of such incident.

The Company deeply regrets any concern or difficulty that this matter may have caused its shareholders, business partners or other stakeholders.

- 1.Background of the Company's Investigation

On December 20, 2010, the Company received an overview report from HT's investigation committee with respect to inappropriate trading activity with several seafood companies by HT's Foodstuff Division, Seafood Section. On the same day, the Company, with the cooperation of external counsel and certified public accountants, established an investigation committee with Koichi Kondo (Executive Vice President, Representative Director and Compliance Officer of the Company) as the Committee Chairperson. This committee conducted its investigation by interviewing the relevant individuals and examining and analyzing electronic data and internal company reports. - 2.Summary of the Investigation Results

The following is a summary of the results reported by the investigation committee.

(1) Summary of inappropriate trading activities

Set forth below is a summary of the inappropriate trading activities found through the investigation, which were undertaken by the previous section chief of the Seafood Section of the Foodstuff Division of HT (the "Responsible Individual").

- The Responsible Individual joined HT in July of 2000 after working in the seafood industry at another company.

- Beginning in approximately 2001, aiming toward the full scale entry of HT into the seafood industry, the Responsible Individual began inventory management trading1 of seafood such as "whitebait" with various seafood industry parties on behalf of HT, with the approval of HT's management and his supervisors.

- 1."Inventory management trading" means transactions in which HT temporarily purchases seafood products from seafood companies with the promise that they will buy back such products after a certain period, in order to bridge the gap between the purchasing period (the fishing season) and the sales period for seafood products.

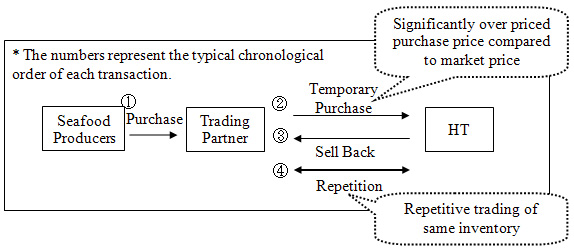

- In January 2004, the Responsible Individual received a request from an important inventory management trading counterparty to purchase additional inventory for an inflated price, taking into account the ¥1 billion loss the counterparty had realized through inventory management trading as a result of spoiled inventory. The Responsible Individual, without the consent of his supervisors, purchased the inventory at a price which was inflated compared to the market price, and continued to make such purchases thinking that if HT didn't purchase the inventory at an inflated price, the counterparty would be unable to repurchase the inventory held by HT which would create problems within HT, and also thinking that the counterparty's failure would be detrimental for HT's seafood business. In addition, as some of HT's trading partners became insolvent and cancelled orders between the fall of 2004 and 2005, the Responsible Individual, in the same manner, purchased inventory from seafood companies at inflated prices in exchange for them taking HT's unsalable inventory. Furthermore, since this period, some counterparties started reselling to HT the same inventory in a circular trade structure, due to their difficulty in repurchasing the inflated inventory from HT, and the Responsible Individual granted tacit approval for such trading.

- Since 2007, HT's management and the Responsible Individual's supervisors started giving instructions to reduce the total amount held in inventory. However, the Responsible Individual, with the cooperation of an additional staff member from the Seafood Section, continued inventory management trading at inflated purchase prices and circular trading of the same inventory, while repeatedly engaging in coverup attempts to reduce (on paper) the total amount held in inventory. As a result of the inflated prices and circular trading, commissions and interest on the inventory continued to increase until it was discovered in October, 2010. As a result of the continuously increasing purchase prices, counterparties were no longer able to repurchase the inventory.

- In October, 2010 suspicions regarding inflated purchase prices arose within HT triggering an investigation. In this investigation, the Responsible Individual admitted that the purchase prices booked for seafood inventory management trading were artificially inflated, and because seafood companies also admitted this, on October 25, 2010, HT removed the Responsible Individual from his position as section chief and assigned him to the planning and management division. Following such series of events, concerns arose within HT regarding irrecoverable receivables from seafood companies, and the discovery of activity such as circular trading led to HT's launch of an internal investigation committee with a broader focus on inappropriate trading activities not limited to inflated purchase prices paid by the Responsible Individual. The findings from HT's internal investigation were reported to the Company on December 20, 2010.

- As described above, the inappropriate trading activities were conducted based upon the Responsible Individual's individual motivation and circumstances, and there was no indication of organizational involvement by his supervisors or HT's management. In addition, there was no indication that officers or employees of the Company were previously involved with or aware of any inappropriate trading activities at HT.

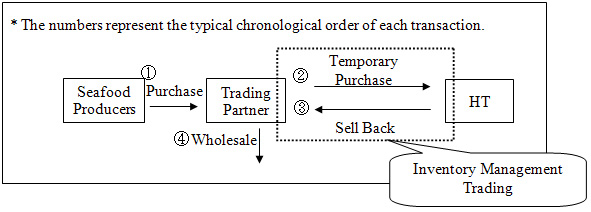

<Example flow of ordinary inventory management trading>

With its inventory management trading partners, typically (1) HT imposes a requirement that counterparties repurchase inventory within one year, (2) counterparties repurchase inventory at a price which includes commission and interest, and (3) during the time that the inventory is held by HT, the risk of spoilage and market risk of the counterparties is born by the counterparties, by agreement.

<Example flow of inappropriate trading activity>

(2) Causes and Areas for Improvement

(i) The Responsible Individual's motivation and background conditions

In the investigation, there was nothing found with respect to the motivation and background conditions of the Responsible Individual's involvement which suggested that he received kickbacks or other personal gain from counterparties.

The Responsible Individual made statements to the effect that the significant factors constituting his motivation and background conditions were the pressure he was under for revenues, and the fact that he also wished to avoid scrutiny of the Seafood Section's losses, so he transferred the losses of the Seafood Section to inventory trading management counterparties and agreed to inflate the purchase prices. While this type of relationship continued, the Responsible Individual and the counterparties gradually developed "give-and-take" relationships, and inventory management trading with inflated purchase prices continued over a long period. Thereafter, as the inventory total rapidly expanded through inflated purchase prices and circular trading, the counterparties' cash flow problems became severe, and since then, trying to evade discovery of a string of problems that could arise from the counterparties' failure, the Responsible Individual continued inventory management trading in a "hand-to-mouth" state.

(ii) Main reasons for the delayed discovery of the inappropriate trading activities

The investigation uncovered no evidence of organizational involvement on the part of supervisors and management of HT.

However, the main reasons for why the inappropriate trading activity was allowed to occur and why it was not discovered over a prolonged period, include long term ossification of personnel which gave the Responsible Individual exclusive responsibility for inventory management trading for close to 10 years, and in light of that, management and supervisors did not have sufficient experience and understanding of the seafood industry. Additional factors which led to the delayed discovery may have included problems in risk management, such as HT's credit exposure management system which did not fit with the reality of HT's inventory management trading and functional defects in IT systems, infrequent use of internal whistle-blowing systems, insufficient compliance awareness and a diluted sense of ownership on the part of executives and employees which led to an organization in which managing problematic trading was left entirely to the individual in charge.

(iii) Management and supervision of subsidiaries by the Company

The investigation did not confirm the existence of any significant problems in the Company's group internal controls that would constitute a breach of legal obligations, with respect to the inappropriate trading activities in connection with HT's inventory management trading. However, as discussed below, with respect to measures to prevent recurrence, the Company thinks it important to further strengthen internal control over group subsidiaries and not use the Company's prior corporate governance principle toward subsidiaries based on "independent governance" (jishu jiritsu) as an excuse.

- 3.Preventative measures

Based on the inappropriate trading activities at HT and the results of the investigation committee's report, the Company will endeavor to further enhance corporate governance by strengthening group governance, increasing compliance awareness and strengthening risk management systems. At the same time, the Company will undertake a reexamination of personnel management systems and build a system for suitable business judgment, in compliance with the law and company regulations.

(1) Strengthening group governance

(i) Strengthening internal control systems

With respect to HT and for each of the Company's subsidiaries, the Company will establish a mechanism to monitor operations and the condition of internal controls at group companies by requiring organization and department heads to confirm adherence to legal and company regulations and the operation of risk management systems, and to regularly report the results to supervisors and the parent company.

The Company will verify the operation and condition of internal controls at subsidiaries, and strengthen cooperation with each subsidiary's "compliance officer" who implements a mechanism for compliance, to support the most appropriate system maintenance.

The Company will establish a system for monitoring the supervision and governance conducted by seconded employees who serve as outside directors and external auditors of the subsidiaries.

The Company will support and confirm, across the board and on a day-to-day basis, holistic maintenance of internal control systems at its subsidiaries.

(ii) Strengthening internal auditing systems

With respect to the Company's operational audit of subsidiaries, the Company will enhance the operations and procedures for preliminary audits and while strengthening operational audits, clearly articulate audit standards so that audits can be conducted more effectively from a compliance standpoint.

The Company's operational audit office will cooperate with the audit departments of subsidiaries and construct a mechanism for internal audit of subsidiaries to be strengthened and for continued improvement of audit functions.

(2) Improving awareness of compliance

(i) Thoroughly revisiting compliance awareness

The Company will strengthen awareness of legal obligations and responsibilities among the directors and auditors of its subsidiaries.

The Company will conduct a review of Honda group's code of conduct, "Our Course of Action", from the standpoint of increased awareness of legal compliance and fair trading, as well as address common awareness of these matters.

Among the group companies, the Company will strengthen communication of new developments in regulation and industry and the risk concerns they raise.

The Company will, through the Company's "Corporate Ethics Improvement Proposal Window" which accepts proposals relating to corporate ethics as the principal conduit, strengthen support for group companies to swiftly grasp and solve group company risks.

(ii) Strengthening the function of the compliance officer

The Company will strengthen awareness of the role of the "Compliance Officer" among group companies and increase compliance responsibilities.

(3) Strengthening risk management systems

(i) Strengthen risk management and supervision

HT will thoroughly oversee, on a regular and consistent basis, the formulation and maintenance of HT's company rules regarding credit limits, internal approval and inventory management and implementation of the rules from the board of directors.

The Company will strengthen oversight of the financial situation of HT by improving HT's IT system for managing revenues and inventory, with increased capability for internal controls.

(ii) Strengthen risk management and supervision at the administrative level

HT has halted inventory management trading in its Seafood Division and will withdraw from the seafood business, concentrating its management resources in fields in which it can demonstrate Honda group's strength and capability.

The Company will establish and clarify the guidelines and discussion items of the important management meetings of HT and Honda's group subsidiaries.

The Company will strengthen the risk analysis undertaken at the time of entry by a group subsidiary into a new business.

(4) Changes to personnel systems

Since one of the causes of this incident is the fact that one employee held the same responsibilities over a long period, HT is revising its long term ossification of personnel and instituting a policy of timely and appropriate personnel rotations. The Company will conduct fundamental reviews on the sustainability of a specific business or department in such case where there is a likely risk from long term ossification of personnel.

- 4.Impact on the Company's financials

The Company made adjustments in the third quarter (October 1 to December 31, 2010) of the consolidated 2010 reporting period for overstated net sales and other operating revenue of ¥9.888 billion and related operating costs and expenses which were recognized in the first half (April 1 to September 30, 2010) of the consolidated 2010 reporting period.

In addition, in recognition of past losses as a result of this incident as of the beginning of the third quarter of the consolidated 2010 reporting period (October 1 to December 31, 2010), the Company recorded one-time charge in this quarter of ¥14.403 billion as Selling, General and Administrative Expense. As a result, operating income was reduced by the same amount in that reporting period.

The Company does not consider the above to have a material impact on the consolidated financial position or operation results with respect to the first three quarters of the consolidated 2010 reporting period taken cumulatively and individually or prior reporting periods (on and before March 31, 2010).

- 5.Responsibility and reprimand of individuals involved

In order to illustrate the responsibilities of the related persons, as of February 14, 2011 the following disciplinary measures and personnel actions were conducted.

| Title (as of February 13, 2010) | Name | Reprimand/ Status | Reduction/Period |

| HT Board Members | |||

| President & CEO | Motohide Sudo | Resigned | |

| Director of Financial Management Operations | Mikio Kimura | Resigned | |

| Director of Living Essentials Operations | Akio Takemoto | Resigned | |

| Auditor | Shinichiro Oka | Resigned | |

| Auditor | Reiji Matsuura | Resigned | |

| Director of Corporate Administration Operations | Koji Masuda | Reduction in pay | 30% × 3 months |

| Senior Managing Director | Tomonao Osaka | Reduction in pay | 20% × 3 months |

| Managing Director | Tadashi Matsumoto | Reduction in pay | 20% × 3 months |

| Managing Director | Akira Takeshita | Reduction in pay | 20% × 3 months |

| Director | Junji Yamazaki | Reduction in pay | 20% × 3 months |

| Director | Takashi Mori | Reduction in pay | 20% × 3 months |

| Director | Kazushi Mitsui | Reduction in pay | 20% × 3 months |

| Director | Hideaki Murai | Reduction in pay | 20% × 3 months |

| Director | Nobuhiko Shiozaki | Reduction in pay | 20% × 3 months |

| HT Employees | |||

| Former Seafood Section Chief | Punitive dismissal | ||

| Seafood Section Employee | Asked to resign | ||

| Consumer Goods Division Chief | Asked to resign | ||

| Chief Controller | Demoted | ||

| The Company | |||

| Director in charge of HT | Yoichi Hojou | Reduction in Company pay | 20% × 3 months |

- 6.Newly appointed officers of HT

At an extraordinary general meeting of shareholders of HT held on February 14, 2011, the following individuals were elected officers and auditors and appointed President & CEO of HT.

| President & CEO | Shigeru Takagi |

| Director | Hiroshi Iwakami |

| Auditor | Tatsuro Ito |

| Auditor | Seiichi Kubota |

| (Appendix) |

|

| [HT General Information] | |

| Location | Daiichi-Tekko Building, 2F, 1-8-2 Marunouchi, Chiyoda-ku, Tokyo, Japan |

| Date of Establishment | March 21, 1972 |

| Capital | 1.6 billion yen |

| Shareholders | Honda (100%) |

| Representative | President & Representative Director: Shigeru Takagi |

| Business Lines | Parts for motorcycle/automobile/power equipment; automotive equipment and machinery; non-ferrous metals; steel/plastics; agriculture, forestry and marine products |

| Sales | Consolidated: 588.6 billion yen Non-consolidated: 251.3 billion yen (year ended March 2010) |

| Place of Business | (Domestic) Tokyo, Nagoya, Osaka, Suzuka, Kumamoto, Tochigi, Sayama, Gunma, Hiroshima (International) United States, Canada, Brazil, Mexico, United Kingdom, Italy, Turkey, Belgium, Romania, Thailand, China, Philippines, India, Pakistan, Vietnam, Indonesia, Taiwan, Malaysia, S. Korea, Russia, Argentina |