Inappropriate Trading Activities by a Honda Subsidiary

January 24, 2011, Japan

Honda Motor Co., Ltd. (the "Company") today announced that the Seafood Section of the Foodstuff Division of Honda Trading Corporation ("HT"), a consolidated subsidiary of the Company, was found to have been involved in inappropriate trading activity. HT is a consolidated subsidiary of the Company, providing trading functions within the Honda Group for such products like seafood and agricultural products, in addition to products, parts, facilities and raw materials for the Company's business. The Company deeply regrets any concern or difficulty that this matter may have caused its shareholders, business partners or other stakeholders.

- 1.Background of the Company's Investigation

On December 20, 2010, the Company received an overview report from HT's investigation committee with respect to inappropriate trading activity with several seafood companies by HT's Seafood Section, Foodstuff Division. On the same day, the Company, with the cooperation of external counsel and certified public accountants, established an investigation committee with Koichi Kondo (Executive Vice President, Representative Director and Compliance Officer of the Company) as the Committee Chairperson. Through this committee, the Company is currently investigating the facts, causes, responsible persons, measures to prevent future occurrences, and the occurrence of any similar inappropriate trading activity within HT. - 2.Latest Summary of Inappropriate Trading Activities

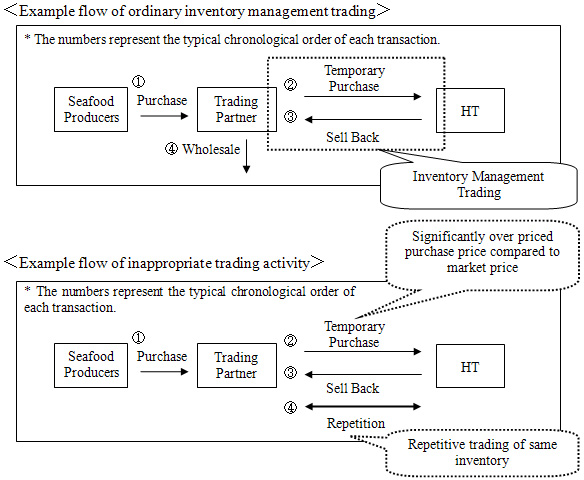

- HT's Seafood Section has a long history in inventory management trading (*). However, since 2004, through the actions of an employee of HT's Seafood Section, HT became involved in purchasing inventory significantly over priced compared to market price, and repetitive trading and circular trading of the same inventory among a number of its business partners.

- Further, in order to avoid attention to the growing outstanding inventory within HT's Seafood Section, certain portions of inventory were temporarily sold to other business partners with the promise that HT would buy back such inventory in the future.

- As a result of such inappropriate trading activity, HT is facing expansion of its inventory credit against such business partners and delays in collecting trade receivables.

- *"Inventory management trading" means transactions in which HT temporarily purchases seafood products from seafood companies with the promise that they will buy back such products after a certain period, in order to bridge the gap between the purchasing period (the fishing season) and the sales period for seafood products.

- 3.Impact on the Company's Financials

Due to such inappropriate trading activity, HT is facing impairment of inventory and trade receivables, and delinquencies in collecting receivables resulting in a total estimated loss of approximately 15 billion yen.

Although, the revenue, profit, inventory and trade receivables in the Company's past quarterly consolidated financials were overstated, due to the impact of such over statements, the Company plans to reflect such revisions in the Company's consolidated financials for the latest quarter (3rd quarter of the Company's fiscal year ending March, 2011) as the amount of such revisions is not material (significant). The impact on the pre-tax earnings of the Company's consolidated financials is estimated to be approximately 15 billion yen.

- 4.Future Actions

With respect to such inappropriate trading activity, the Company's investigation committee is continuing its investigation into the cause, responsible persons, measures to prevent future occurrences, and the occurrence of any similar inappropriate trading activity, and will announce results as soon as they become available.

[End]

| (Appendix) | |

| <HT General Information> | |

| Location | Daiichi-Tekko Building, 2F, 1-8-2 Marunouchi, Chiyoda-ku, Tokyo, Japan |

| Date of Establishment | March 21, 1972 |

| Capital | 1.6 billion yen |

| Shareholders | Honda (100%) |

| Representative | President & Representative Director: Motohide Sudo |

| Business Lines | Parts for motorcycle/automobile/power equipment; automotive equipment and machinery; non-ferrous metals; steel/plastics; agriculture, forestry and marine products |

| Sales | Consolidated: 588.6 billion yen Non-consolidated: 251.3 billion yen (year ended March 2010) |

| Place of Business | (Domestic) Tokyo, Nagoya, Osaka, Suzuka, Kumamoto, Tochigi, Sayama, Gunma, Hiroshima (International) United States, Canada, Brazil, Mexico, United Kingdom, Italy, Turkey, Belgium, Romania, Thailand, China, Philippines, India, Pakistan, Vietnam, Indonesia, Taiwan, Malaysia, S. Korea, Russia, Argentina |