Delivering Attractive Products and Services to the World

“Let’s change the landscape of the automobile industry.” In 1963, inspired by this rallying cry, Honda’s automobile business began and has since expanded to offer products to customers in diverse regions worldwide. Evolving the cultivated “joy of driving” that Honda embodies, aligning with the changing times and relentlessly pursuing the development of innovative technologies within the “Five Key Factors,” our goal is to achieve the realization of value in delivering “the transcendence of various constraints of movement and the augmentation of people’s possibilities.

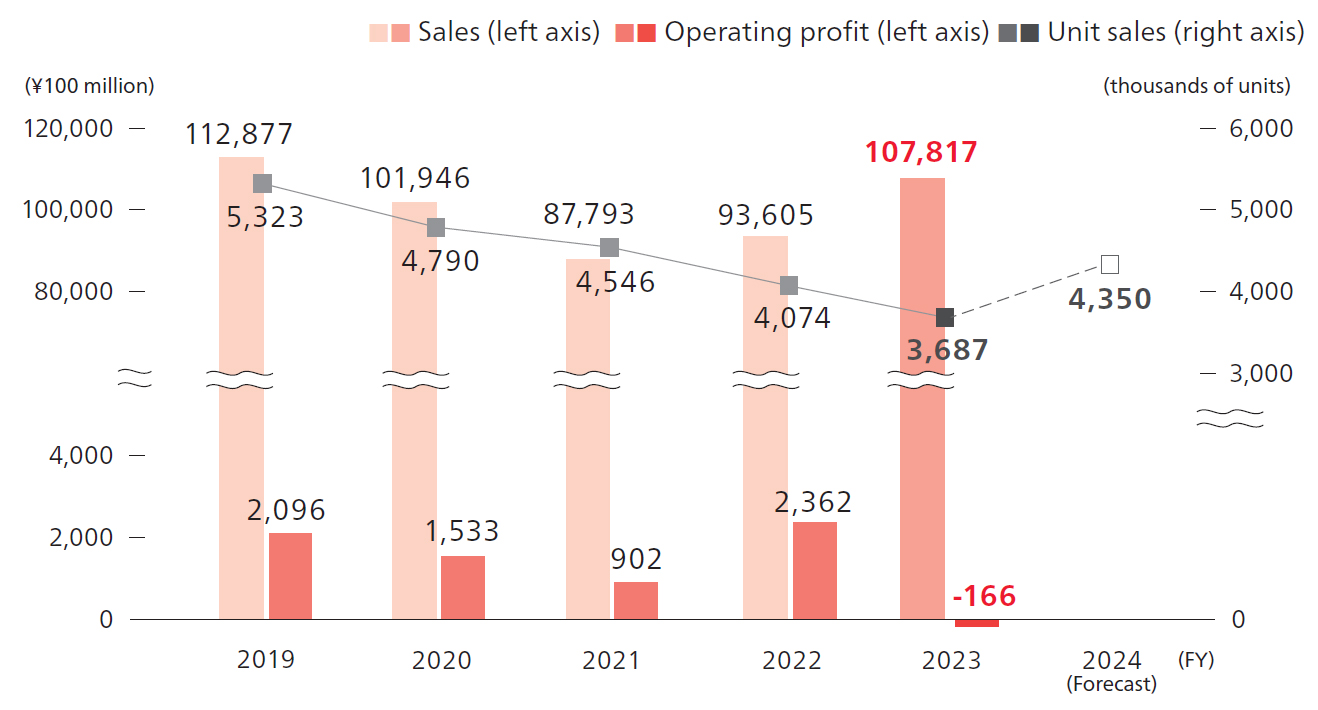

Revenue Highlights of the Automobile Business

Recognition of the External Environment / Key Challenges

In the BEV market, it’s not just traditional automobile companies making a mark. Various manufacturers from different industries are now introducing a wide variety of BEVs, ranging from budget-friendly to premium models. As customer needs and values diversify, it’s becoming increasingly challenging for Honda to differentiate its BEVs by traditional strengths like engine performance and other. This highlights an urgent need for Honda to carve out a distinct identity in the BEV market, rooted in its unique value and UX.

With electrification on the rise, there’s an anticipated surge in demand for minerals like nickel, lithium and cobalt, all essential for battery production. This has raised concerns about potential skyrocketing battery prices due to possible shortages in these raw materials. Honda is taking proactive measures against such risks, especially in parts procurement, including batteries. Our focus is on promoting recycling, reusing materials and incorporating sustainable materials, aligning with the vision of a resource circulation.

Moreover, we recognize the imperative to cultivate a flexible and resilient organizational structure for more rapid decision-making in order to swiftly transition our business focus towards electrification.

Direction of the Electrification Business Strategy

The advancement of electric mobility is an initiative that stands as the cornerstone of our mission to achieve a society where “all individuals can feel the joy and freedom of mobility.” As we amplify our endeavors to realize “zero environmental impact and zero traffic collision fatalities”, addressing mobilityrelated challenges, our commitment to the “Joy of Driving” – a principle Honda has cherished since its founding – remains unwavering. Moreover, we aim to offer every customer “Surprise, Excitement and Trust” by introducing fresh mobility experiences. It is sustained by the “Joy of Using” and the “Joy of Connection,” facilitated by connectivity and intelligence that align with the ever-evolving.

Medium- to Long-term Targets

By 2030, our goal is to set up a global BEV production system that produces over 2 million units annually. By 2040, we aim for a sales ratio where 100% of our global sales comprise EVs and FCVs.

The Direction of the Product Lineup and Future Product Development Strategy

We view the shifts in business structure, value propositions and production processes in the BEV era as an opportunity to deliver a new value through UX in tune with diversifying customer values. As we pioneer new value propositions for electrified vehicles, our products will reflect the “spirit of sporty car-making” inherent in Honda’s DNA. Furthermore, by globalizing our product lineup, we aim to drive product development with a compelling brand message.

| Region | Products to be introduced |

| North America |

• In 2024, Honda will introduce the “PROLOGUE,” while Acura will unveil the “ZDX,” both of which are co-developed with GM. • In 2025, Honda will launch a mid- to large-sized EV incorporating a new E&E architecture*, built on Honda’s dedicated EV-specific platform. |

| China | • The “e:NS2” and the “e:NP2” are set to launch in early 2024. • A mass-production model inspired by the “e:N SUV 序” concept, which was unveiled at the Shanghai Motor Show in April 2023, is scheduled for release by the end of 2024. • Including these three models, a total of 10 EV models will be introduced by 2027. |

| Japan | • An N-VAN-based commercial-use mini-EV model will be launched in the first half of 2024. • Following this, an EV based on the “N-ONE” will debut in 2025. Two compact EVs, including an SUV model, are slated for release in 2026. |

| Europe | • The “e:Ny1,” a model from the “e:N” series for the European market, will be launched sequentially across European countries starting in the fall of 2023. |

- * E&E architecture: Integration of Electrification and Electronics Technologies (Electrification & Electronics Architecture)

Toward the Early Independence of the Electrification Business

To achieve early autonomy in the BEV business, we are committed to addressing the following themes:

・Initiate an allocation strategy with the battery as the focal point to bolster our business structure, emphasizing management resource allocation.

・Evolve the UX to align with the diversifying values of customers.

・Broaden customer touchpoints and augment service offerings through a lifecycle-centric approach.

・Forge a new brand identity by merging software and hardware, inclusive of establishing a digital service infrastructure.

・Enhance production efficiency and value by introducing a global model.

・Lay the groundwork and advance technology for an information infrastructure that paves the way for a sustainable society.

Initiatives in the Battery Area

Specific Initiatives

・Battery Strategy

・Charging and Infrastructure Strategy

・SW (Software) Strategy

・BEV Production System

Battery Strategy

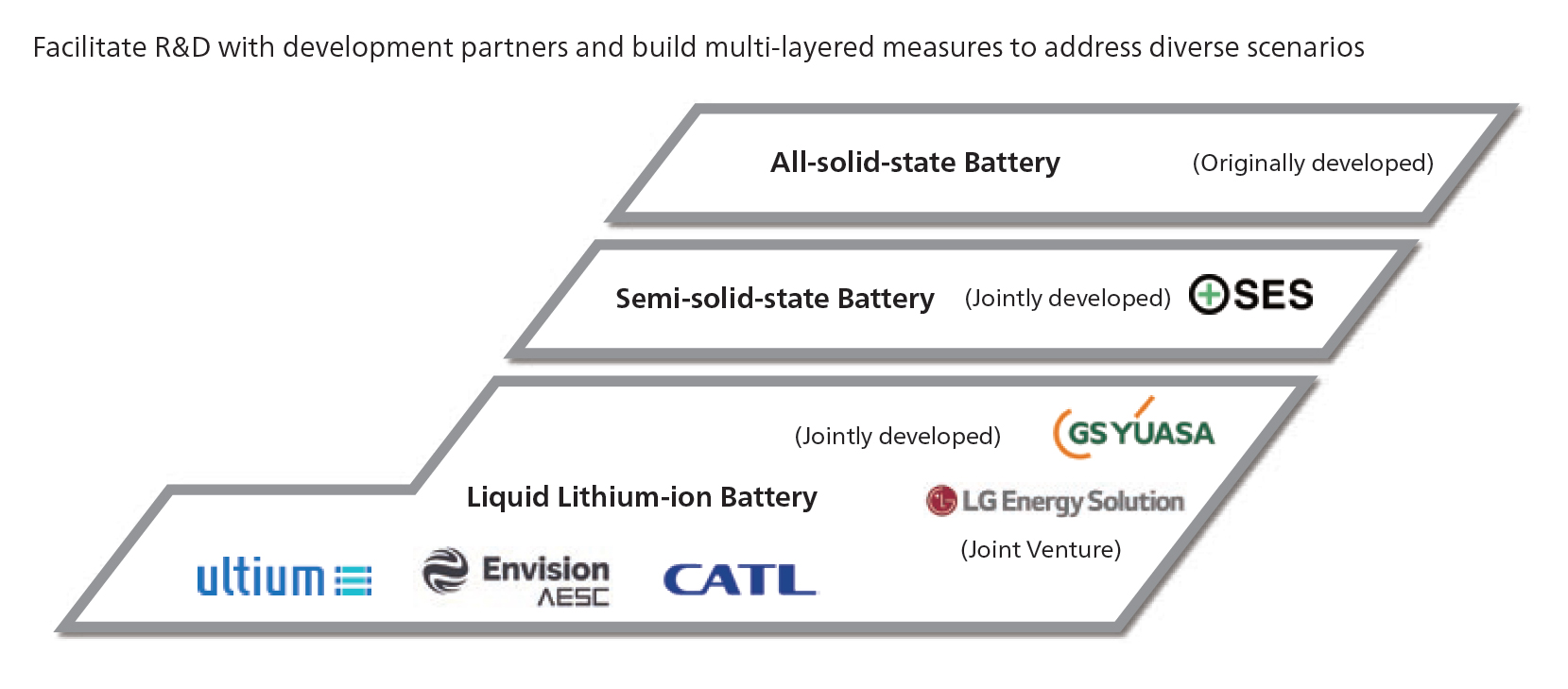

We will address the rapid pace of electrification by formulating a variety of battery procurement strategies to meet both current and anticipated needs.

Beyond our procurement of liquid lithium-ion batteries, we plan to initiate mass production of batteries in North America by 2025 through a joint venture with LG Energy Solution Ltd, aiming to establish a new value chain. For the procurement of essential minerals, we have formed partnerships with Hanwa Co., Ltd. and POSCO Holdings Inc. Additionally, we collaborate with Ascend Elements, Inc. and Cirba Solutions, LLC in the recycling sector.

From the late 2020s, we will not only advance our liquid lithium-ion batteries but also develop and introduce next-generation batteries, including semi-solid-state and all-solid-state varieties. To enhance the performance of our liquid lithium-ion batteries, we will collaborate with GS Yuasa Corporation to develop high-capacity and high-power versions specifically for EVs, supporting Japan’s rapid electrification. Furthermore, our investment in SES Holdings Pte. Ltd. will bolster the joint development of semi-solid-state batteries. Our goal is to produce batteries that are safe, have high capacity and exhibit increased durability. Regarding all-solid-state batteries, we’re ramping up efforts to initiate a demonstration line in Sakura City, Tochigi Prefecture by 2024, targeting a market launch by the late 2020s.

Charging and Infrastructure Strategy

We are actively working on expanding charging services in line with our growth in the BEV market. To promote the adoption of EVs in North America, seven companies, including Honda’s U.S. subsidiary, American Honda Motor, BMW Group, GM, Hyundai, Kia, Mercedes-Benz Group and Stellantis N.V., have agreed to form a joint venture. Their goal is to establish a high-capacity EV charging network across the U.S. and Canada. The first charging station is slated to open in the U.S. by the summer of 2024, with subsequent expansions focusing initially on metropolitan areas and major highways.

The station will feature multiple high-output DC chargers compatible with all vehicles adhering to charging standards such as CCS*1 and NACS*2. With environmental considerations in mind, all power will be sourced exclusively from renewable energies. The initiative aims to deploy at least 30,000 chargers across the U.S. and Canada, establishing a high-power recharging network that is user-friendly for EV drivers. For home charging, we will utilize Honda Smart Charge, an established EV charging service in North America, and plan to gradually introduce smart energy services that leverage the power supply capabilities of EVs.

- *1 CCS: Combined Charging System

- *2 NACS: North American Charging Standard

SW (Software) Strategy

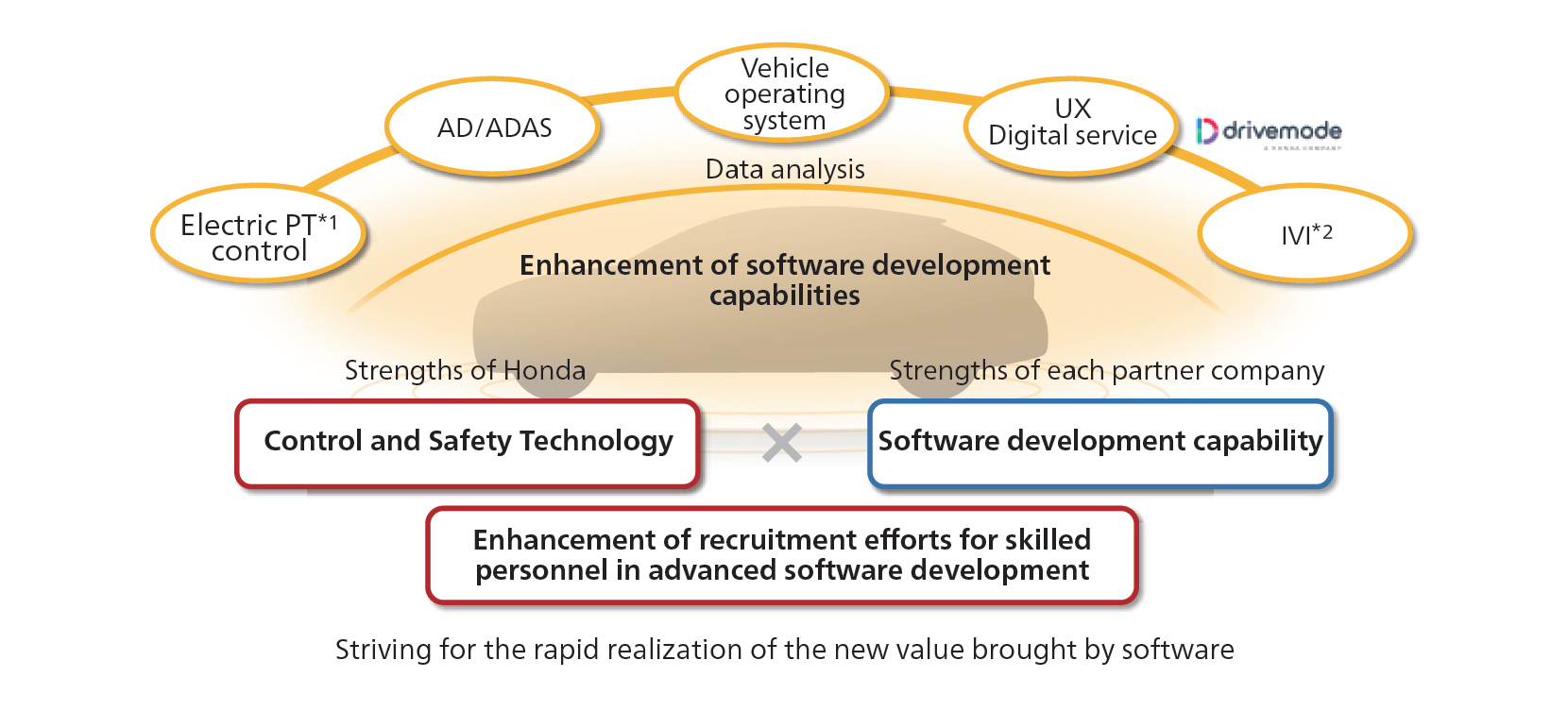

Under the “Software-Defined Mobility” concept, which delineates the value of both hardware and services, we are accelerating our software development. Specifically, Honda is advancing the E&E architecture and developing its unique vehicle OS, aiming for its adoption in the mid-size and large EVs set to launch in North America in 2025. Using this vehicle OS as a foundation, Honda will continue to evolve its in-vehicle software, offering advanced functions and services even after the vehicle purchase. Furthermore, we will swiftly provide digital services highly compatible with BEVs, centered on safety, comfort and reliability. These services, designed with a focus on UX, will be offered under a unified management, including user-friendly charging guidance and other appealing features.

Regarding the proprietary development of software in areas such as vehicle OS, AD/ADAS, UX and digital services, we plan to double our recruitment of skilled professionals specializing in advanced software. We will also actively bolster our collaborations with partners to amplify our capabilities. Through our partnership with SCSK Corporation, we will merge Honda’s system control and safety control technologies with SCSK’s IT expertise. This synergy aims to maximize the potential of engineers from both companies, offering continuous training and skill enhancement. Furthermore, by deepening collaborations with development partners like KPIT Technologies Limited and by pioneering initiatives in fields like electrification and ADAS with Hitachi Astemo, Ltd., we seek to fuse Honda’s strengths in control and safety technologies with the software development prowess of our partners, thereby realizing the new value that software can bring.

In the realm of digital services, we aim to enhance software development to consistently provide outstanding user experiences (UX) from the customer’s perspective. To achieve this, we have appointed the CEO of Drivemode, Inc. as the new Global UX Officer, centralizing decision-making authority.

Advancements in Software Technology

- *1 PT: Powertrain

- *2 IVI: In-Vehicle Infotainment

BEV Production System

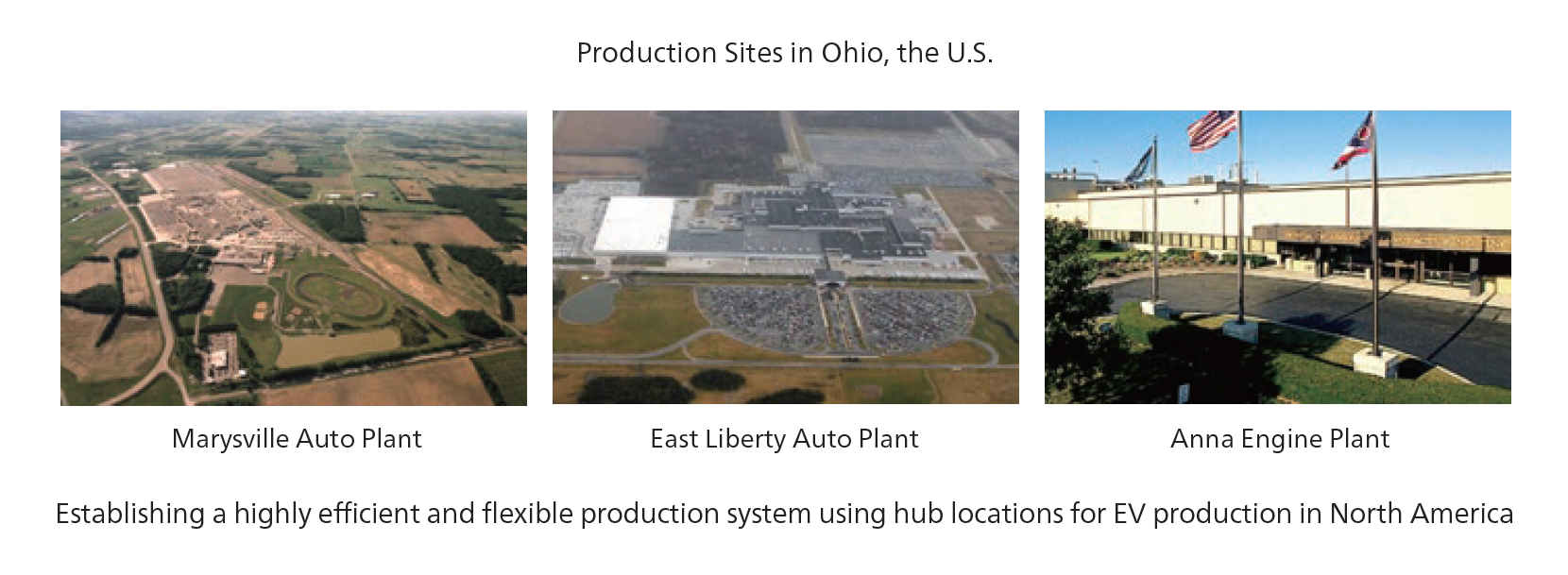

In response to the rapid electrification worldwide, we are advancing the establishment of an electric vehicle production system globally within Honda. In North America, Honda has identified its three existing plants in Ohio (Marysville and East Liberty, which produce automobiles, and the Anna Engine Plant, which manufactures automobile powertrains) as central locations for EV production. While utilizing these existing facilities, we are constructing efficient and highly flexible EV production lines.

Moreover, with an eye on the EVs set to launch in the late 2020s, we have initiated the transformation of our production system towards a “state-of-the-art BEV manufacturing facility.” We will approach this transformation from the following three perspectives:

1) Evolution of factories capable of producing products with strong appeal efficiently and flexibly, and the establishment of a supply chain.

2) Development of production lines that prioritize automation and intelligence to adapt to future workforce shifts.

3) Transition to production processes that emphasize resource circulation, with a commitment to minimizing CO2 emissions to the greatest possible extent.

In anticipation of higher production volumes post-2030, we aim to offer competitive BEVs with significant product appeal and price competitiveness through the global expansion of the state-of-the-art BEV manufacturing facility.

Strengthening of the EV production

ICE Business “Hybrid Evolution”

Alongside the acceleration of electrification, we remain committed to continuous development, ensuring we deliver attractive products to customers who choose ICE vehicles.

We’ve implemented the Honda Architecture, which distinctly differentiates between the “common components” and “unique components” for each vehicle model, in the full redesign of the CR-V and Accord. Building on this foundation, we will persist in advancing this initiative. By merging a “Modular Architecture with Unified Components and Layout” with the “Shared Utilization of BEV Advanced Technologies,” we aim to extend state-of-the-art features, including advanced safety technologies, to ICE vehicles as well. Starting in 2026, these features will be incorporated into our core model lineup for worldwide expansion. Furthermore, with the introduction of a lightweight platform, next-generation power units and electric AWD, we commit to delivering superior environmental performance and enhanced dynamic capabilities.

From a business perspective, we will accelerate the standardization of lineups and powertrains globally to enhance business efficiency and establish a complementary structure, including production across various regions.

To swiftly address evolving customer needs, we will continue to deliver appealing products by implementing measures such as shortening development timelines and utilizing derivative series.

CR-V

Accord (for North American market)